- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

As per the Canada Revenue Agency (CRA):

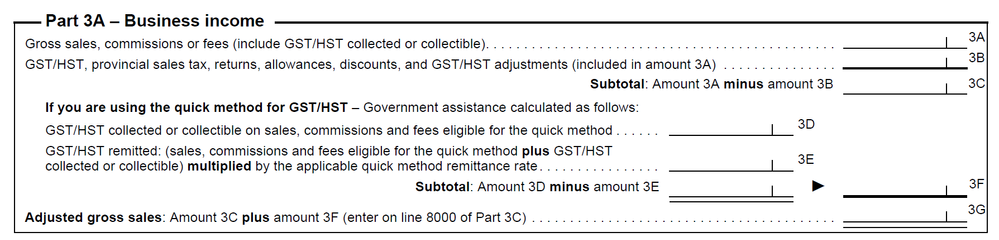

When filling out form T2125, you have some items that need to be included, please see as following:

At amount 3A, enter the gross sales, commissions or fees (including GST/HST, collected or collectible).

At amount 3B, enter any GST/HST, provincial sales tax, returns, allowances, discounts and GST/HST adjustments (included on amount 3A).

If you are using the quick method of accounting to calculate your GST/HST remittances, calculate government assistance as follows:

- At amount 3D, enter GST/HST collected or collectible on sales, commissions and fees that are eligible for the quick method

- For each applicable remittance rate, include the sales, commissions and fees eligible for the quick method plus GST/HST collected or collectible. Multiply this amount by the quick method remittance rate and enter the result on amount 3E. This is the amount you enter on line 105 of your GST/HST return (or line 103 if you are filing your GST/HST return on paper)

- The subtotal at amount 3F is amount 3D minus amount 3E

Thank you for choosing TurboTax.

April 22, 2024

8:01 AM