- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

For TurboTax Desktop, please follow the steps below:

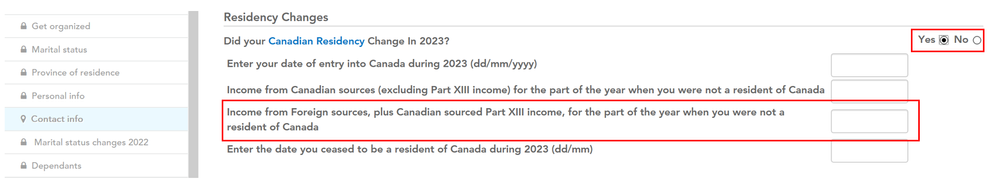

- For the portion of your income from foreign sources when you were not a resident of Canada, go to the contact info page and enter the amount under Residency Changes section.

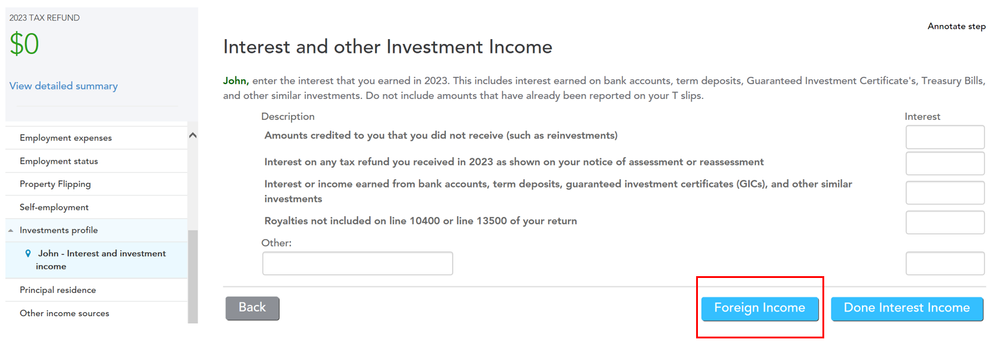

- For the portion of your income from foreign sources when you were a resident of Canada, go to Income & Expenses -> Investments Profile -> Select Interest and Investment Income and click Continue -> Click Foreign Income under Interest and other Investment Income page -> Enter the interest you earned from Froeign sources when you were a resident in the Income from Foreign Sources page

- Foreign income needs to be reported in Canadian dollars. Use the Bank of Canada exchange rate in effect on the day that you received the income. If you received the income at different times during the year, use the average annual rate. The average monthly rate and the daily rate are available by visiting the Bank of Canada.

April 23, 2024

7:34 AM