- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Hi Jessica,

Thank you for getting back promptly and noted that I should include all income that I earned in my home country before I became a resident of Canada under the section you mentioned.

Follow-up questions:

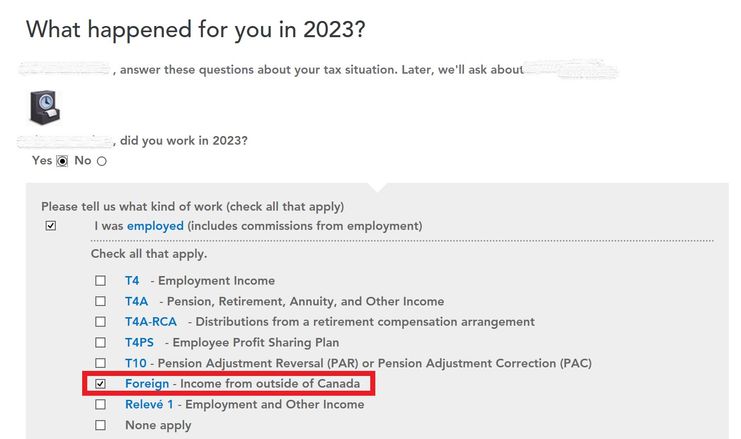

(1) Do I still need to input this amount again in the section "Foreign Income from outside of Canada" shown below? Or this section is just for the amount I earned after I became a resident of Canada?

(2) Please advise what should I include in the "Foreign Income from outside of Canada"? Employment Income? Investment Income? Or all income?

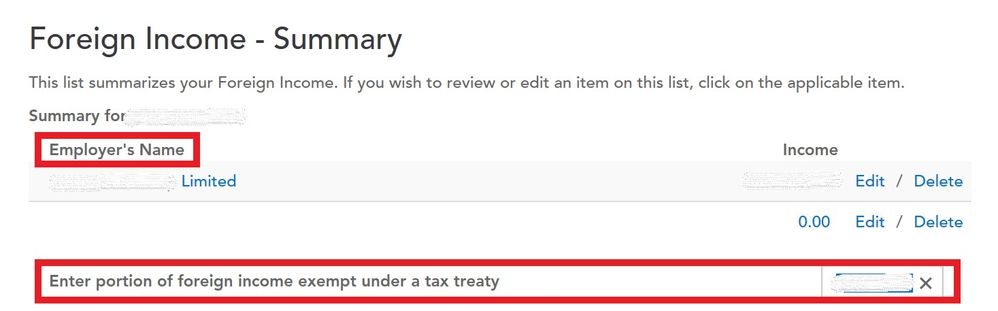

(3) For the below "Foreign Income -Summary", should I include "Employment Income" only? Amount should be for the whole year or just after I became a resident of Canada? What do I need to input for "Enter portion of foreign income exempt under a tax treaty"?

Thank you so much for your help.