- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in the T1 final return do I enter the capital loss from making an election 164(6)?

I am filing a GRE trust return for a deceased person. It includes stock market capital losses. I am making an election 164(6) to transfer these losses to the deceased person's final T1 return in order to reduce its capital gains. I need to know where to enter the value for the loss on the T1 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

We’re sorry for your loss

Unfortunately TurboTax does not support T3 Trust Income Tax returns, for a deceased person.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

You have a good question. I have the same one.

The frustration is so ironic when the tax seminar presenters spout out this great tax advice but no one actually knows how to do it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

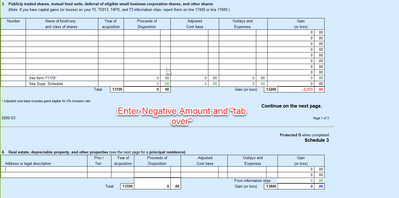

Here is how you would enter it in TurboTax Desktop.

You then can go to your T1 General and verify that 50% of the amount went to line 12700.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

The graphic does not reflect the orginal gain as reported at death. I would not override - merely enter on Schedle 3 a line item citing 164(6) election.