Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Getting started

- :

- I entered scholarship income but turbotax final PDF file doesn't display it

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered scholarship income but turbotax still says my income is 0, is that normal?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered scholarship income but turbotax still says my income is 0, is that normal?

Students who enroll full-time and are entitled to the tuition deduction are not required to claim scholarship money appear in Box 105 of the T4A tax slip as taxable income, except when related to employers and businesses.

The following qualify for the scholarship exemption and are considered non-taxable:

- scholarships

- awards

- bursaries

- fellowships

For more information, please click:

TurboTax Financial Awards That Qualify for the Scholarship Exemption

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered scholarship income but turbotax still says my income is 0, is that normal?

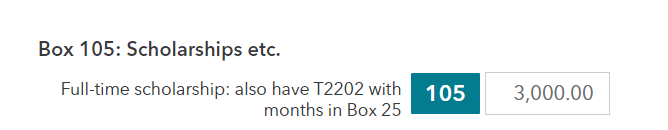

So just to confirm, this isn't a bug? I entered 3000 in box 105

but when I finish the T4A slip says this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered scholarship income but turbotax still says my income is 0, is that normal?

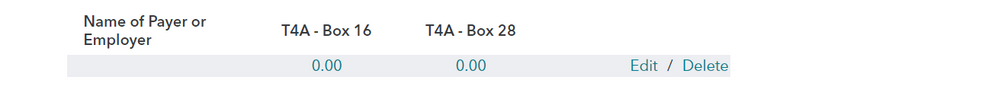

As you can see in your screenshot, the T4A Summary page only shows the amounts in Box 16 & Box 28. Your amount in Box 105 will not show up on the T4A summary, though it is still included as part of your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered scholarship income but turbotax still says my income is 0, is that normal?

My son is fulltime student and he entered scholarship amount on T4A box 105 but when he creates PDF file to submit the return, this amount is not displayed anywhere.

Unlock tailored help options in your account.

Related Content

vandy1966pz

Level 1

blue_lightning23

Returning Member