Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Getting started

- :

- Re: When will this form be ready? T777S - Statement of Employment Expenses for Working at Home Du...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will this form be ready? T777S - Statement of Employment Expenses for Working at Home Due to COVID-19

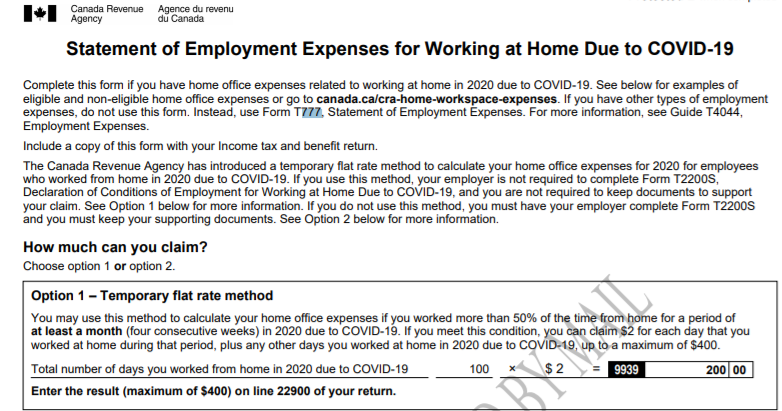

Please read my full response over again. You only put in the number of days. The rest is a simple multiplication by $2 that the system automatically does. I would screenshot the actual form, but I've completed my return already. As an alternative, I've attached an anonymized screenshot of the T777S TurboTax generated for me. You can see by the watermark that this was created by TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will this form be ready? T777S - Statement of Employment Expenses for Working at Home Due to COVID-19

I see, I thought there will be new page showing this form so its auto-generated once you input the number of days. thanks for the help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will this form be ready? T777S - Statement of Employment Expenses for Working at Home Due to COVID-19

it doesn't look like the turbo tax form is calculating the credit properly. any info in when it might get fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will this form be ready? T777S - Statement of Employment Expenses for Working at Home Due to COVID-19

What about the credit is calculated correctly? As I show above, it works fine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will this form be ready? T777S - Statement of Employment Expenses for Working at Home Due to COVID-19

the detailed method gives no option currently to claim a designated work space.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will this form be ready? T777S - Statement of Employment Expenses for Working at Home Due to COVID-19

Ah, for the detailed method you may want to create a new thread. This thread hasn’t really touched on that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will this form be ready? T777S - Statement of Employment Expenses for Working at Home Due to COVID-19

Hi it seems that the employment expenses using the detailed method (with a designated room - due to covid) is not calculating properly and missing some input information.

I have entered my amounts under employment expenses for each relevant line on the T777S (ie: rent, electricity etc) but nothing is flowing to line 22900, that line remains zero. Maybe its not working because we are also supposed to also enter the square footage of the designated room over the total square footage to determine the percentage used form employments use. However I don't see where we would enter this info.

Turbotax, please advise if I am missing a step, or if the form has yet to be finalized by you and when you will be updating it .

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will this form be ready? T777S - Statement of Employment Expenses for Working at Home Due to COVID-19

That’s what I noticed too it only deducted 122 even I put the max. Number of days working from home

- « Previous

-

- 1

- 2

- Next »

Related Content

jesse97lee1@gmai

New Member

amyklimosko

New Member

perc479283

New Member

logger-murray

New Member

keramchugh-gmail

New Member