- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- ADU added to property with another rental

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ADU added to property with another rental

Hello,

I have a standard 3br house that I've rented out for 7+ years. I just recently had a detached an ADU built on the same property (most of labor came from myself), which was put into service 3/1/2022. Both the house and ADU are/have been rented out. Have separate addresses, and utility hookups. And I have no mortgage on either of them.

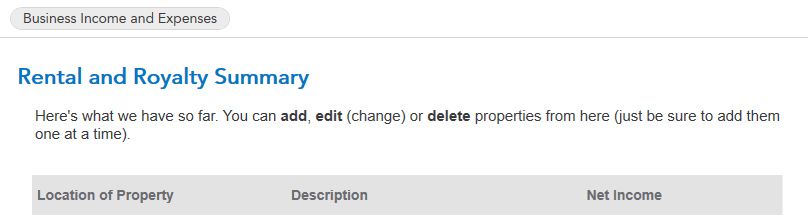

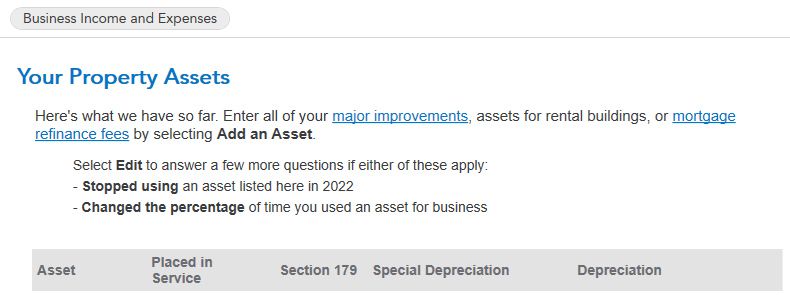

One question is, would I enter the ADU as its own property under "Rental and Royalty Summary" or would I add it under the original house's property under "Your Property Assets" as a "major improvement?" (see pics).

Also, would the rental income that I made from the new ADU just be combined with the original house's rental income, if I did add it as a major improvement?

Lastly, I understand if I depreciate the total cost basis as a major improvement, would I be able to do individual appliances as well on top of the total?

Hope this makes sense, entering uncharted territory. 🙂

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ADU added to property with another rental

Have separate addresses, and utility hookups. And I have no mortgage on either of them.

You can do either way. But what may be best depends on one factor we don't know.

Before the ADU, did you receive one property tax bill for everything?

After the ADU, do you still receive one tax bill for both structures and the land they are on? Did you take necessary actions to sub-divide so that each property is taxed separately now by your property taxing authority? (The county I presume.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ADU added to property with another rental

Hey! Thanks for the reply.

Before the ADU, did you receive one property tax bill for everything?

Before the ADU was built I got one property tax bill for the one parcel.

After the ADU, do you still receive one tax bill for both structures and the land they are on?

I do not get a separate tax bill for the ADU on the property currently. Nothing comes up when I type the ADU's address in the assessor's website, so I'm assuming its all the same still.

Did you take necessary actions to sub-divide so that each property is taxed separately now by your property taxing authority? (The county I presume.)

I did not sub-divide the parcel. It is still one big parcel.

What do you think would be best for my situation? Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ADU added to property with another rental

While there's two ways to treat this, here's how I would do it. Regardless of the method you chose, there's pros and cons to both.

I'd just add the ADU as an additional asset to the existing rental, classified as residential rental real estate depreciated over 27.5 years. For that asset in the COST box I'd enter the amount I actually paid for that structure. Then in the COST OF LAND box enter zero, because I did not pay anything for the land I already own and built it on.

Pros :

- You just enter one figure for the total rent received from both structures. If you have one structure vacant for a period of time between renters, no big deal. You really don't have any vacant period so long as at least one of the rentals is occupied by a paying renter for the entire tax year. The only way you'd have a vacant period, would be if both rentals were vacant at the same time.

- I don't have to pro-rate and allocate land values between the two rentals, which can make for a "tenie-tiny" hassle adjusting the land value on the existing rental without messing up the existing structure value - which could completely screw up the depreciation history if not done right.

- I don't have to bother with allocating insurance and property tax deductions between two separate rentals. (Assuming you have one policy for the entire property, and did not take out a separate policy for the ADU)

- If I for any reason, convert either one of the units to personal use, it's just a simple matter of converting that one asset to personal use to stop depreciation on that one asset. (converting back to a rental will require manual math and a bit of work on your part, no matter what you do. It's just unavoidable.)

- If you sell the entire property in the future, you only have to report a single transaction, and don't need to bother with splitting it between two separate properties.

- Cons:

- If you sell only one of the structures, more than likely this scenario will include a portion of the land in the sale requiring you to report the sale as two separate transactions and adjust the land allocation on the unit you keep, accordingly. (one sale for the structure, the other sale for a portion of the land.) While a bit of work, it's perfectly doable and, if done right would reduce the land value according for the portion of land you keep, and not mess up your depreciation history on the structure you keep.

- If you have any "personal use" of either structure while it's classified as a rental, it will require a bit of manual math on your part to get the allocations right.

- If you convert only one of the units to personal use and stop depreciation on that unit for a period of time, and then later want to convert it back to a rental, it's not as simple as selecting the option to indicate you converted it from personal use back to a rental. it will "require" some manual math on your part and a completely new entry in the assets/depreciation section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ADU added to property with another rental

Thanks for all the info Carl. For clarification:

- I don't have to bother with allocating insurance and property tax deductions between two separate rentals. (Assuming you have one policy for the entire property, and did not take out a separate policy for the ADU)

I have two separate insurance policies, one for the house, one for the ADU. Not sure if this matters, as there are two separate leases, with two different tenants.

- I'd just add the ADU as an additional asset to the existing rental, classified as residential rental real estate depreciated over 27.5 years. For that asset in the COST box I'd enter the amount I actually paid for that structure.

So I would enter the grand total of the ADU in the cost box? And not depreciate the smaller items themselves within it, such as the stove, fridge, etc.?

This is in California by the way, if that means anything. Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ADU added to property with another rental

I have two separate insurance policies, one for the house, one for the ADU.

Then just make one single entry for insurance costs, which would be the total of both policies.

Not sure if this matters, as there are two separate leases, with two different tenants.

Doesn't matter really. Using my scenario, for the taxes, you'd just enter the total of all rents received from all tenants.

So I would enter the grand total of the ADU in the cost box? And not depreciate the smaller items themselves within it, such as the stove, fridge, etc.?

I'd total everything up and enter it as a single asset. I find it a waste (just my opinion) to separate things out to depreciate them faster. Many folks don't realize that depreciation is not a permanent deduction. When you sell the property you are required to recapture that depreciation and pay taxes on it in the year you sell. Two things with that.

- While recaptured depreciation is taxed at the "ordinary" tax rate, it gets added to your income and therefore increases your AGI.

- There is the possibility that the increased AGI could be enough to bump you into the next higher tax bracket. Now weather it actually does that or not, just depends on the numbers. But it's darn near impossible to predict what your AGI will be years from now when you sell the property, and you also can't predict how tax laws may change in that time.

Now I'm not saying to not separate things out if you want to. I'm just giving you my opinion on why I would not - and we all know what opinions are like.

If you do separate things out such as the appliances, you'll need to label those assets in such a way so that you know which rental property asset those other assets belong to. That will matter if something happens, such as selling one property, or if there's a fire in one property and those separated assets are also destroyed.

For me, I have a mortgage on all 3 of my rental properties. Knowing that I will have to recapture depreciation at some time in the future when I sell the property, I do what I can to keep my depreciation as low as I legally can. Even doing that, I still show a loss every single year on the SCH E.

Now for you with no mortgages, I really can't predict or even guess with any accuracy, how things work out for you each year with the bottom line on your SCH E. Maybe you show a little profit? Maybe you still show a loss? For me, if I showed a profit I'd still keep my depreciation as low as legally possible. I'd rather pay a lower tax on a little profit each yere, than risk the probability of paying a higher tax on a lot of profit in the year I sell the property. But that's me. You have to make your own decision. All I can advise is that you do your homework so you can feel comfortable with an "educated" decision for your specific and explicit situation and possible future outcomes.

This is in California by the way, if that means anything.

My condolences. 🙂 I can only imagine your tax liability as being "at least" double what I pay, since you pay both federal and state taxes. The cost of the licensing requirement (for the CRT or whatever you call it there) is probably high as a kite too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ADU added to property with another rental

My condolences. I can only imagine your tax liability as being "at least" double what I pay, since you pay both federal and state taxes. The cost of the licensing requirement (for the CRT or whatever you call it there) is probably high as a kite too.

That ain't even the half of it! 😆 Thanks for all the help Carl! Much appreciated.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

nomad

Returning Member

y_and_y

New Member

rhalexda

Level 2

rhalexda

Level 2

huntinad

Level 1