Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Investments & rentals

- :

- A husband is deemed to a Canadian resident, a wife is non resident, but on the system, it's assumed a wife is a Canadian resident. How can I change it?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A husband is deemed to a Canadian resident, a wife is non resident, but on the system, it's assumed a wife is a Canadian resident. How can I change it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A husband is deemed to a Canadian resident, a wife is non resident, but on the system, it's assumed a wife is a Canadian resident. How can I change it?

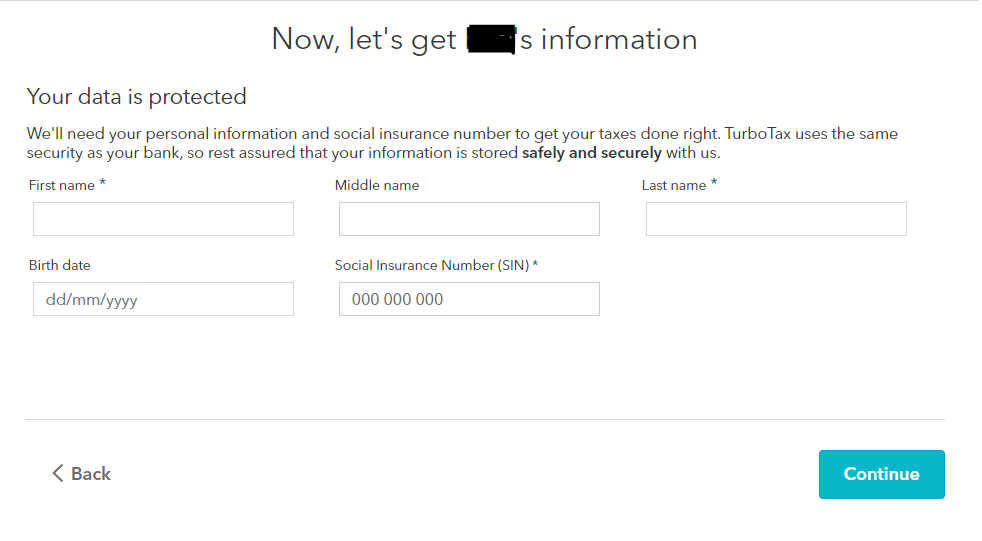

TurboTax is unable to choose residency status, it has to be selected. In the section for selecting the province where you live, scroll to the bottom and choose non-resident under your wife's profile. Then make the appropriate selection when completing/entering your wife's information. See screenshot attached

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A husband is deemed to a Canadian resident, a wife is non resident, but on the system, it's assumed a wife is a Canadian resident. How can I change it?

Hi Admin,

I am using Turbo tax Online in 2018. The screen you shared to me is completely different with my screen. This is a step showed by Turbo tax online in 2018. There is nothing mentioned about it. When I do my income tax, the software ask her information. I fill them in. My wife is non-resident, I don't need create her profile.Because I add her in, total tax refund is different without her. It means the system assume her status is Canadian resident. Can you please help me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A husband is deemed to a Canadian resident, a wife is non resident, but on the system, it's assumed a wife is a Canadian resident. How can I change it?

If you continue it will ask if you live together and if she is a resident.

Related Content

ongkatrina-gmail

New Member

kayla_hickey-hot

New Member

dyoung8500

Returning Member

havanraj

New Member

sharlotterl-gmai

New Member