Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Québec taxes

- :

- Quebec - Work from home expenses

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quebec - Work from home expenses

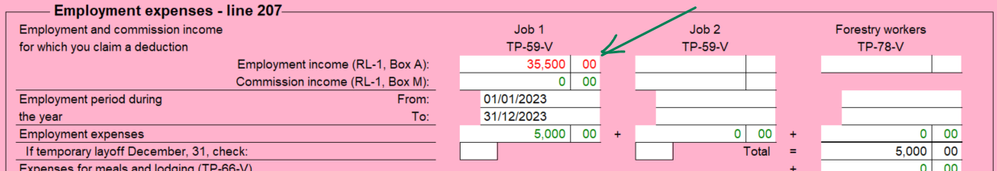

I live in Quebec, but work in Ontario. I received a T4 for my employment income and a RL-1 for the employer paid portion of my health benefits (~$2500), which is considered as income in Quebec. I am trying to claim work from home expenses on my Quebec return (line 207) and am having a few issues that I need help with. On Form TP-59, the employment income fields only pull from my RL-1 and not my T4, which therefore doesn't reflect my actual employment income. Because of this, Turbo Tax isn't let me claim employment expenses for my Quebec return. It seems like this is an error with Turbo Tax's automatic calculations for my employment income. Do I need to override line 207 to reflect my actual employment income (amount from T4 + RL-1)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quebec - Work from home expenses

Our best option will be to contact our Customer Support line at 1-888-829-8608, they will assist you with this matter, as you can share your screen and they will be able to try different scenarios.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quebec - Work from home expenses

Hello @niklu1

In forms mode, simply double-click on the amount showing on line 64 of the TP-59. That will bring you to the "QDED" worksheet where you can simply override the "Job 1 - Employment income" field to represent the total Quebec income you received from this employer.

In other words, the sum of your Ontario's T4, box 14 plus the RL1 box A.

Does this help?

Unlock tailored help options in your account.

Related Content

kimm-bajwa

New Member

marco-espinosa-a1985

New Member

imfitcoaching

New Member

chaulkwanda

New Member

osaldarr01

New Member