Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Seniors & students

- :

- After reviewing a filed tax summary and it states that I am not eligible for the Climate Action Incentive, when looking at requirements, I should be, why was it removed?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After reviewing a filed tax summary and it states that I am not eligible for the Climate Action Incentive, when looking at requirements, I should be, why was it removed?

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After reviewing a filed tax summary and it states that I am not eligible for the Climate Action Incentive, when looking at requirements, I should be, why was it removed?

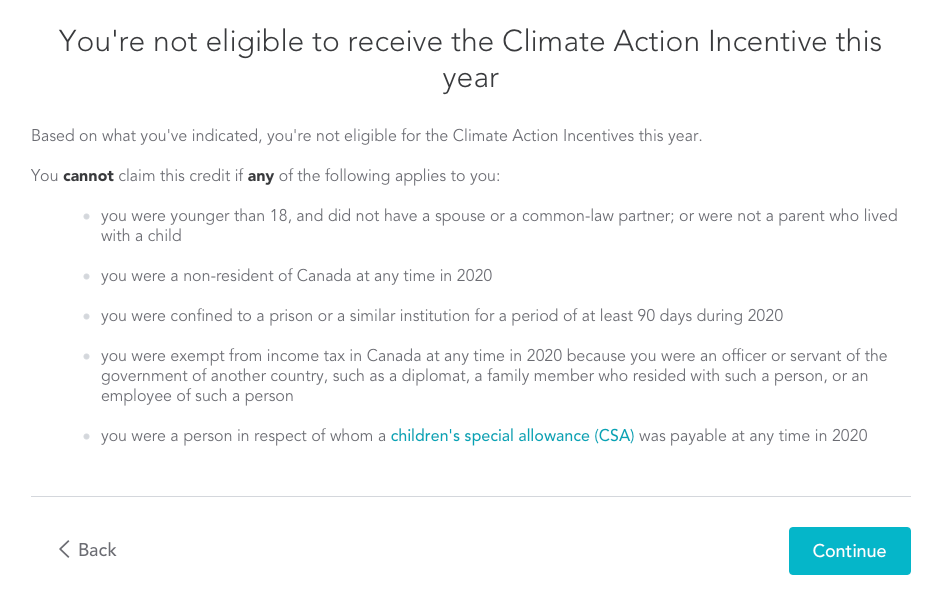

Climate Action Incentive- will only be removed if you answered "YES" to any questions they asked you when you went to "Provincial" and to the page that says Let's see if you qualify for Climate Action Incentive- if you answered Yes to any of these - Then you do not qualify and the credit will be removed.

This credit will be found in the Federal tax summary and not Provincial

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After reviewing a filed tax summary and it states that I am not eligible for the Climate Action Incentive, when looking at requirements, I should be, why was it removed?

Climate Action Incentive- will only be removed if you answered "YES" to any questions they asked you when you went to "Provincial" and to the page that says Let's see if you qualify for Climate Action Incentive- if you answered Yes to any of these - Then you do not qualify and the credit will be removed.

This credit will be found in the Federal tax summary and not Provincial

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After reviewing a filed tax summary and it states that I am not eligible for the Climate Action Incentive, when looking at requirements, I should be, why was it removed?

I entered no toall the questions but it stills says zero on the climate action incentive.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After reviewing a filed tax summary and it states that I am not eligible for the Climate Action Incentive, when looking at requirements, I should be, why was it removed?

The Climate Action Incentive is a new, refundable tax credit starting in 2019; it can be applied for by eligible individuals on their 2018 personal tax return. ... The new tax credit is available to residents of Manitoba, New Brunswick, Ontario, and Saskatchewan.

As per CRA- You cannot claim the CAI payment if at any time in 2019 you were any of the following:

- a non-resident of Canada

- confined to a prison or a similar institution for a period of at least 90 days during the year

- an officer or servant of the government of another country, such as a diplomat, or you were a family member who lived with such a person or an employee of such a person

- a person for whom a children special allowance was payable

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After reviewing a filed tax summary and it states that I am not eligible for the Climate Action Incentive, when looking at requirements, I should be, why was it removed?

It say's I am qualified for a climate action incentive but did not show any amount?

how does it work then? is there a problem or glitch on the system.

Its my first time to file tax return and I am 17 years old. does this matter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After reviewing a filed tax summary and it states that I am not eligible for the Climate Action Incentive, when looking at requirements, I should be, why was it removed?

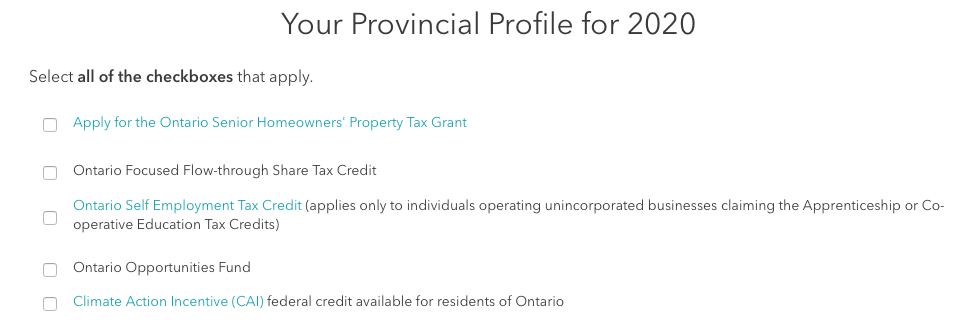

I am seeing the same thing... none of the boxes are selected on the Provincial profile page.

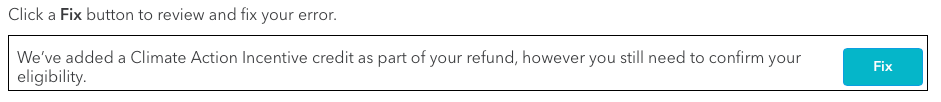

But I am getting the error / warning:

When I select "Fix", all I get is this...

If I select "Continue" it brings me back to the Warnings / Errors page.

Related Content

braun1299-gmail-

New Member

miigaa0053-gmail

New Member

macbear

New Member

kara-bayduza

New Member