Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Seniors & students

- :

- Box 105 - Which box for full time student?

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 105 - Which box for full time student?

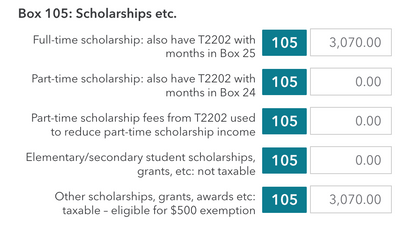

I was a full-time student for 8 months in 2022 and received a scholarship/grant from my school, I believe I do meet the criteria for the taxable bursary exemption, but the system automatically inputs the grant as a taxable income line 105 with the eligibility for $500 exemption. Do I input the grant as a full-time scholarship or as an "Other Scholarship grant" that is taxable?

Topics:

posted

March 20, 2023

12:00 PM

last updated

March 20, 2023

12:00 PM

1 Best answer

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 105 - Which box for full time student?

Use the one for "full time scholarship T2202 with months in box 25"

May 1, 2023

12:09 PM

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 105 - Which box for full time student?

Use the one for "full time scholarship T2202 with months in box 25"

May 1, 2023

12:09 PM

Unlock tailored help options in your account.

Related Content

apezybyn

New Member

abhatia7

New Member

celliottclimb

New Member

Toriesims

New Member

atlantis-jasmine-marie-damien

New Member