Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Seniors & students

- :

- Do i report grants received as part of my canada student loans?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do i report grants received as part of my canada student loans?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do i report grants received as part of my canada student loans?

As per our TurboTax article: What to Claim as Income if You’re a Student

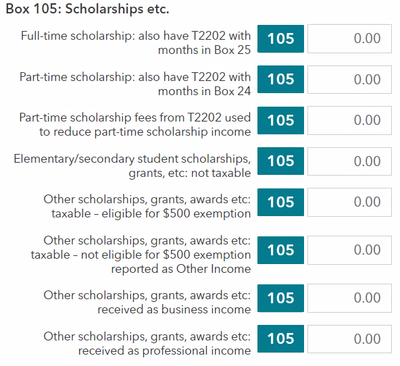

Scholarships, Bursaries and Apprenticeships

A certain portion of scholarships, fellowships and bursaries may be taxed as income, unless you are eligible for the education amount, which is calculated using a formula provided by CRA.

Full tax exemption applies to scholarships, fellowships and bursaries awarded for full-time study toward a diploma or degree, with the exception of postdoctoral study. If you receive an artist’s project grant, you should declare it, but you may use a scholarship exemption, if applicable, to reduce your income.

Apprenticeship grants must be declared as income and will be on your T4A slip.

Please see our TurboTax FAQ below for guidance and steps:

Do I have to report scholarships and other academic awards on my return?

Thank you for using TurboTax.

Related Content

nealgee

New Member

char12862

New Member

sevbatz101

Returning Member

eb7e9f6d3264

New Member

beniashley06-gma

New Member