Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Seniors & students

- :

- Entering unused RRSP contributions from line B of your 2023 RRSP Deduction... produces odd results. If I enter an amount, the refund is $10,000 higher than if I enter $0

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering unused RRSP contributions from line B of your 2023 RRSP Deduction... produces odd results. If I enter an amount, the refund is $10,000 higher than if I enter $0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering unused RRSP contributions from line B of your 2023 RRSP Deduction... produces odd results. If I enter an amount, the refund is $10,000 higher than if I enter $0

Are you using TurboTax CD/Download or TurboTax Online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering unused RRSP contributions from line B of your 2023 RRSP Deduction... produces odd results. If I enter an amount, the refund is $10,000 higher than if I enter $0

Using the Turbo Tax CD.Download

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering unused RRSP contributions from line B of your 2023 RRSP Deduction... produces odd results. If I enter an amount, the refund is $10,000 higher than if I enter $0

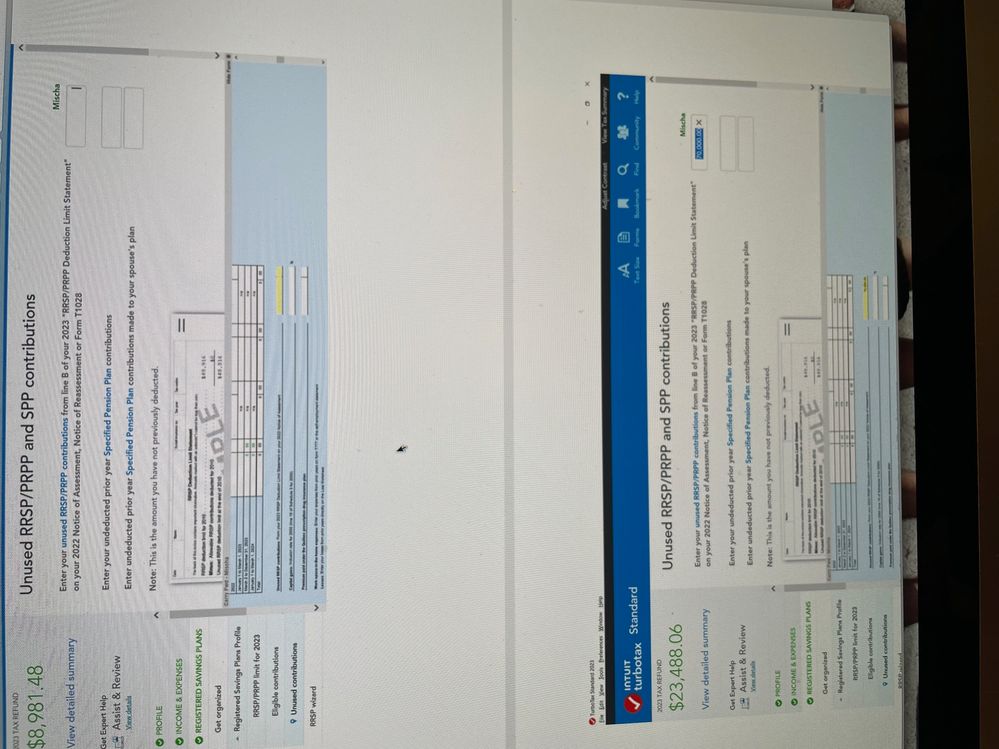

Can you possibly take a picture or screenshot of where you are at when you enter the unused amount which makes your refund go so high?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering unused RRSP contributions from line B of your 2023 RRSP Deduction... produces odd results. If I enter an amount, the refund is $10,000 higher than if I enter $0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering unused RRSP contributions from line B of your 2023 RRSP Deduction... produces odd results. If I enter an amount, the refund is $10,000 higher than if I enter $0

It looks like it is trying to take a deduction of the full $70,000. If you enter an amount to carry forward, does it lower the refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering unused RRSP contributions from line B of your 2023 RRSP Deduction... produces odd results. If I enter an amount, the refund is $10,000 higher than if I enter $0

Yes, the amount entered directly impacts the Tax Refund, so, if $1,000 is entered in the Unused RRSP/PRPP contribution amount the refund is less than if a greater amount is entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering unused RRSP contributions from line B of your 2023 RRSP Deduction... produces odd results. If I enter an amount, the refund is $10,000 higher than if I enter $0

Please contact our phone support team at 1-888-829-8608 as they will be better able to assist you.

Related Content

jeck_tinitigan

New Member

rhondamisener

New Member

nicolefletcher20

New Member

Ashrafsakr36

Level 1

nklanguageconsul

New Member