- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How to do Deductible Home Mortgage Interest adjustment for California?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

So my home mortgage has a principle over 1M. It started before 2017 December. For my federal return, TurboTax correctly calculated that the deductible interest amount is 1M / average principle * total interest paid.

For California state return, per the CA form 540 instructions (https://www.ftb.ca.gov/forms/2020/2020-540-ca-instructions.html, Line 8 – Home Mortgage Interest), I should be able to use 1.1M as allowed amount to calculate.

Among the final forms Turbotax exported, I can see that there is a "Deductible Home Mortgage Interest Worksheet" attached to CA state return, calculating a different dedictible interest amount based on 1.1M / average priciple * total interest paid. However, this calculated value is not used anywhere. The CA 540 instructions says "If your deduction was limited under the federal law, enter an adjustment on line 8, column C for the amount over the federal limit.", but column C is empty despite the worksheet included in the return.

Is there a way to fix this or override manually?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

What is your average balance you are using in the calculation? I also can't find a Line 8 column C in worksheet unless it is referring to a third loan.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

Using 1.3M as average balance in calculation, federal return would allow 1/1.3 of total interest to be deductible, and supposedly California return would allow 1.1/1.3 of total interest to be deductible.

line 8 column C is part of CA form 540, mentioned in CA form 540 instructions in the link I posted. It says write the difference in column C which will add onto CA deductible.

The worksheet just calculated a higher deductible amount, but that amount or the difference isn’t used anywhere else in my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

Did you list equity debt in addition to your original loan debt? According to this State of California website, this deduction will allow deductions for home mortgage interest on mortgages up to $1 million plus up to $100,000 in equity debt. Do you have a second 1098 to report that is equity debt in addition to the 1098 for your original loan?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

I do have a second 1098 from refinance, but I did not report it because TurboTax cannot handle 2 1098 at this time (see this thread https://ttlc.intuit.com/community/loans/help/what-do-i-do-if-i-have-multiple-1098s-from-refinancing-...)

I manually merged the two 1098 forms and typed in only one.

> Did you list equity debt in addition to your original loan debt?

so no I did not. Also not sure if the refinance counts as home equity or not.

Even if this does not count and I should not get any extra deduction, it's odd that the final forms included a "Deductible Home Mortgage Interest Worksheet" for my California return, which calculated a higher deduction, yet does not use the value anywhere.. Is there a way to fix that odd form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

Hi, I've had the same issue discussed in this thread, but I don't see a resolution.

Specifically, I have a grandfathered mortgage of about $1.5m. I'm allowed to deduct mortgage interest on upto $1m of the loan, so calculated 1/1.5 (67%) of the interest and entered that for my federal tax return.

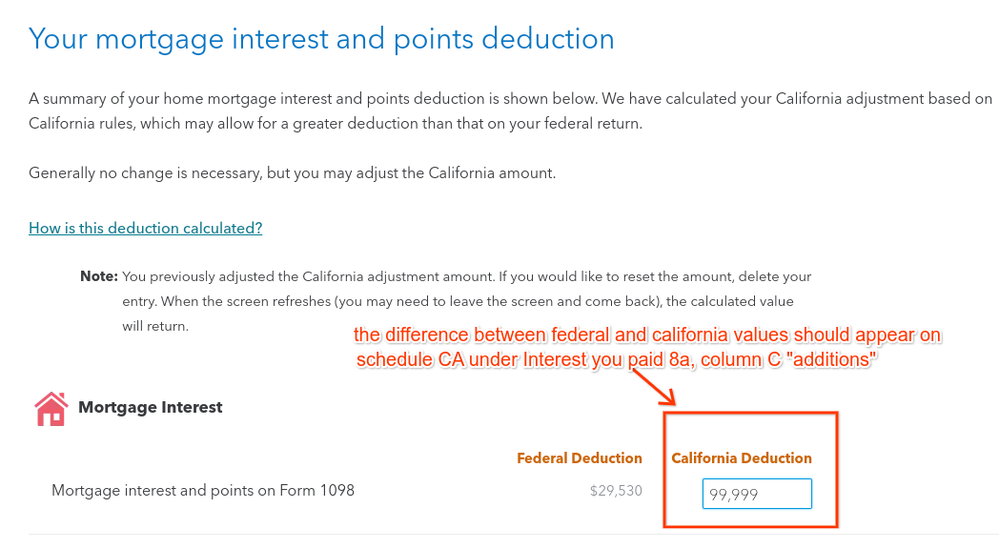

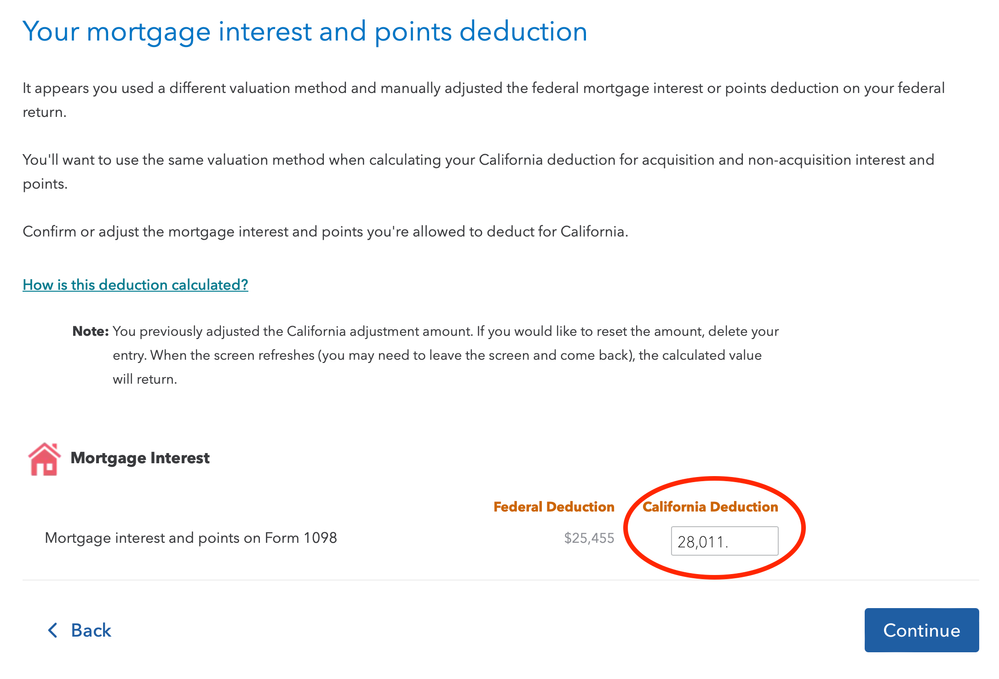

On the CA taxes, there is a screen that allows you to made adjustments to the federal amounts. I use 1.1/1.5 (73%) of the interest paid for CA, however TT doesn't use this number in the CA adjustments page. It looks like a bug on the online TT version.

Can someone help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

I'm having the same problem for 2023 year taxes.

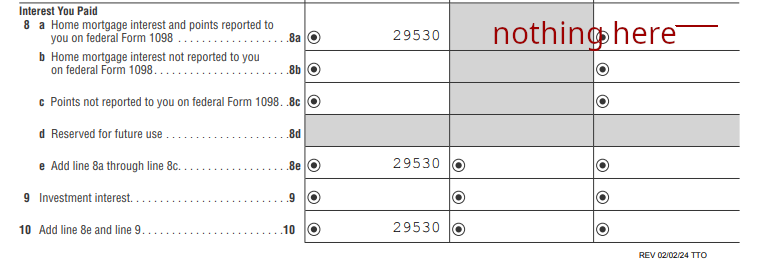

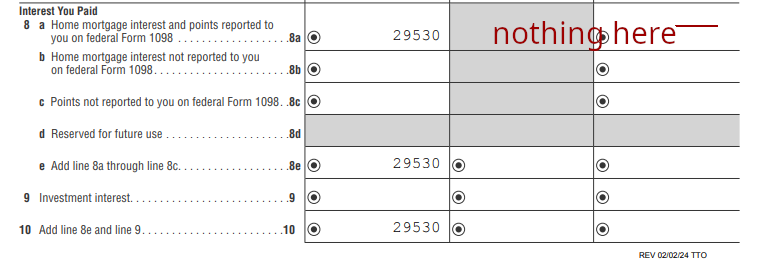

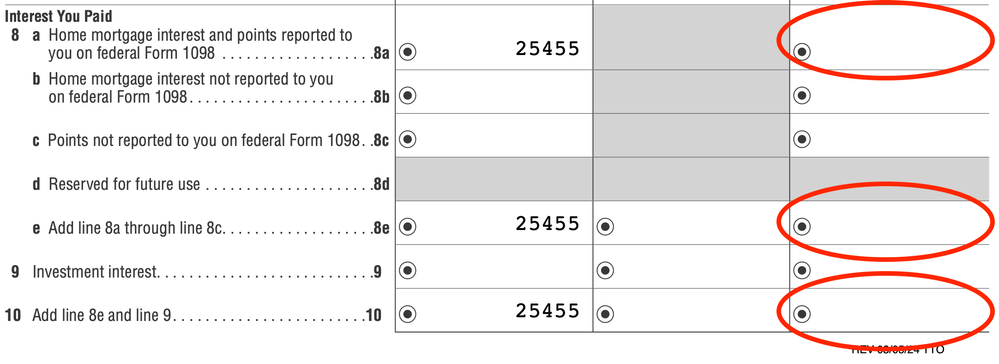

If I go to California > Mortgage Interest Deduction and enter California adjustment amount, it doesn't appear on Schedule CA under Interest You Paid, 8a, Column C (Additions).

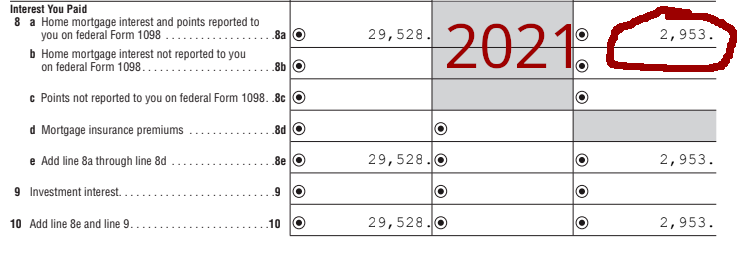

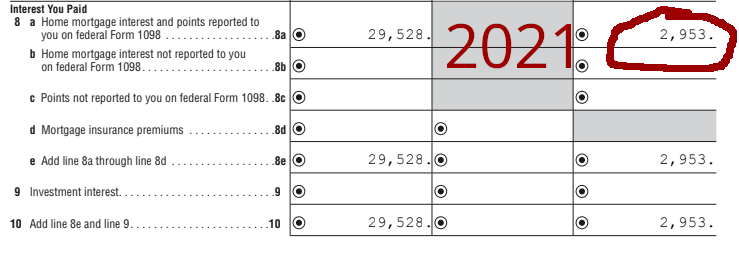

In tax year 2021 TurboTax online got this right. Looking at tax year 2022 and this year, it isn't putting anything in that box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

If you are still getting an error, it would be helpful to have a TurboTax ".tax2023" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions: Go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

Thank you LenaH, yes I am still having this problem.

My token number is 1203399.

I've called support many times and walked through debugging and we've tried a lot of different things:

* Reducing the balance of the mortgage but keeping the federal / state interest figures the same didn't change anything. e.g. it still doesn't let you add $100k of "equity debt" to CA.

* Clearing the state forms.

* Mucking around with other settings.

Basically no matter what you put in the "California Deduction" box for state mortgage interest and points, it never results in any additional interest being output in California Schedule CA "Column C (Additions). "

I went back and checked previous years returns and this worked in 2018, 2019, 2020, 2021, but not 2022 and 2023 tax years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

Thank you for sharing your token. I tested your file using TurboTax Desktop and will report your issue for further review.

I found that the California mortgage interest adjustment can be done in the Desktop version. Please see How do I switch from TurboTax Online to TurboTax Desktop? for instructions on downloading your tax file in TurboTax Desktop so you can complete your return.

Please take the following steps once you open your file in TurboTax Desktop:

- Click on Forms at the top of the page in the blue bar.

- On the left hand side, scroll down to your California forms.

- Click on Schedule CA and scroll down to Line 8a.

- Click on the box and a magnifying glass will appear. Click on the magnifying glass.

- TurboTax will open the Misc. Deductions form.

- Enter 4,767 (34,297 - 29,530) on the first line, which is Mortgage Interest Adjustment.

- Go back to Schedule CA and confirm 8a, 8e, and 10 is 4,767.

- Schedule CA now agrees to the 2023 Instructions for Schedule CA, which state if your deduction was limited under federal law, enter an adjustment on line 8, column C for the amount over the federal limit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

Hi LenaH, thank you... I have two questions:

1. I already paid for TurboTax Online... I didn't notice the issue until I had viewed the final preview tax forms pre-filing and see that the Column C isn't filled. This means I'll end up having to pay for TurboTax Desktop in addition just to fix the error in Online?

2. Will the workaround using Desktop prevent me from e-filing? I saw a help article that says, "Returns that contain overrides cannot be e-filed."

Is it possible they can fix whatever issue exists in TurboTax Online rather than having to switch to the Desktop mode? This functionality used to work in Online since I have never used Desktop and it correctly calculated the value in past tax years (e.g. 2018, 2019, 2020, 2021).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

If you decide to use TurboTax Desktop, you can request a refund of TurboTax Online once you transfer your file. To request a refund, please click here.

You are correct. Returns that contain overrides cannot be e-filed. For additional information, please click here.

This issue is currently being investigated. I will update you further when I receive more information. Thank you for your patience @dh123.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

I am encountering this exact issue with TurboTax Online.

I was auditing the completed tax return forms from TurboTax Online for 2023 before e-filing, and I noticed that the values I entered in the CA state specific "Mortgage Interest Adjustment" flow were not being reflected on the CA Form 540.

Then I went and looked at my 2022 forms (also filed via TurboTax Online), and I saw the exact same issue had happened there as well, but I had missed it last year! I confirmed that this was working correctly in TurboTax Online for 2021 and prior years.

So this seems to be a serious logic regression in TurboTax Online that was introduced last year (TY2022) and remains unfixed as of today for TY2023. This bug in the software is causing me to lose more than $2,500 of itemized deductions for my CA state taxes that I am supposed to receive every year!

See screenshots below showing the correct values I have entered into the TurboTax UI, and the incorrect tax forms generated:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

Please send a diagnostic file that has your input but not your personal information so we can evaluate.

Using TurboTax Online:

- Sign into your TurboTax Online account

- Scroll down to Tax Tools from the menu on the left side .

- Select Tools from the drop-down

- On the pop-up screen, select Share my file with agent

- A message that a diagnostic file gets sanitized and transmitted to us appears

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

Using TurboTax Desktop/Download Versions:

- Open your return.

- Select the Online tab in the black bar at the top of TurboTax and select Send Tax File to Agent

- This will generate a message that a diagnostic copy will be created. Click on OK and the tax file will be sanitized and transmitted to us.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do Deductible Home Mortgage Interest adjustment for California?

@SharonD007 I've already e-filed my return through TurboTax Online, so I don't see a way to get the token number without starting a new amended return. With that said, I really don't believe an investigation into my specific tax file is necessary, as I am clearly hitting the exact same issue that @dh123 encountered, which was already investigated by @LenaH. It's clear that there is a bug in TurboTax Online introduced in TY2022.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

9137421619

New Member

Bob in Plano

Level 3

moscosamykaill

Returning Member

VAer

Level 4

SelenaP

Returning Member