- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to report both W-2 and 1042-S form using Turbo tax free?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

Hi I am in a dead end road here. Turbotax recommends the sprintax partner to declare my 1042 S, but for tax purposes I am a resident. So sprintax does not allow me. I am J1 researcher

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

There aren't any direct entry screens in TurboTax to support form 1042-S. You will report the income/withholding in whichever category of income is appropriate or as "Other Reportable Income" under Miscellaneous Income if you cannot find any other category.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

Hi, Susan, the problem with your advice is that if we had tax withhold on the 1042-S form we can't deduce that. So we are going to be double-taxed. How to inform we already paid tax on the 1042-S??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

As a resident alien with a Form 1042-S, you will report the income and withholding on your Form 1040. The income can be reported in TurboTax Premier under Wages and Income, Less Common Income, Other Miscellaneous Income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

As a resident alien with a Form 1042-S, you will report the income and withholding on your Form 1040.

The income can be reported in TurboTax Premier under Wages and Income, Less Common Income, Other Miscellaneous Income, Other Taxable Income.

The withholding reporting reported on Form 1042-S will be entered entered under Deductions and Credits, Estimates and Other Taxes Paid, Estimated Tax Payments:

IRS Form 1040 Instruction for Line 25c direct withholding from Form 1042-S to be entered here

IRS Form 1040 Instruction for Line 25c direct withholding from Form 1042-S to be entered here

IRS Form 1040 Instructions (see Line 25c for 1042-S withholdings)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

Hey Thais,

How did you file both W2 and 1042S?

I have the same case this year, and would appreciate any advise.

Until Oct 2020 I was a nonresident alien and received salary free of federal tax (treaty between US and Poland) - this is stated in my 1042S.

I also got W2 as from OCtober on I paid tax.

Sprintax does not allow to file anything, in TaxFreeUS there is no 1042S option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

You will be able to file, however, TurboTax does not support the 1042-S form. I know TaxFreeUSA does not support this form 1042-S so I looked and unfortunately nor does TurboTax. Here are the instructions I found for you:

Since TurboTax does not directly support the filing of Form 1042-S, you will need to file a Form 1040-NR. See the information in the link below.

I hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

Wendy, thanks. However the post you provided directs me to Sprintax. Sprintax does not allow me to file, as I am already a resident alien (residency for tax purposes).

What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

The 1042-S is not supported so you have to enter the pertinent information from the form into Miscellaneous Income. The good news, you can use TurboTax if you are a resident alien for tax purposes. See Amy's detailed steps to get your 1042-S income reported on your Form 1040 via TurboTax. @paulinalanga

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

I need to amend a w2 I filed this year.....I didn't know I had to file both w2 from 2020 together.....when I amend the one I've filed, how do I do it? I saw the form but it only lets me download which I assume means I need to print and mail it somewhere????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

Please hold off for just a little while. The 1040X (Amended Return) tax form for 2020 is scheduled to be available 03/25/2021.

You can correct a return that you've already filed and had accepted. Select the year that applies and use this guide to proceed.

Select your tax year for amending instructions: 2020

For additional information please refer to How to Amend

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

Hi Paulina,

My situation is very similar to yours. Could you tell me how you figured your taxes out?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

If you are a resident alien, you can report both the W2 and 1042-S in Turbo Tax. To report the W2, go to:

- Federal

- Wages and Income

- Wages and salaries>form W2

To report the 1042-S

- Open your return in TurboTax

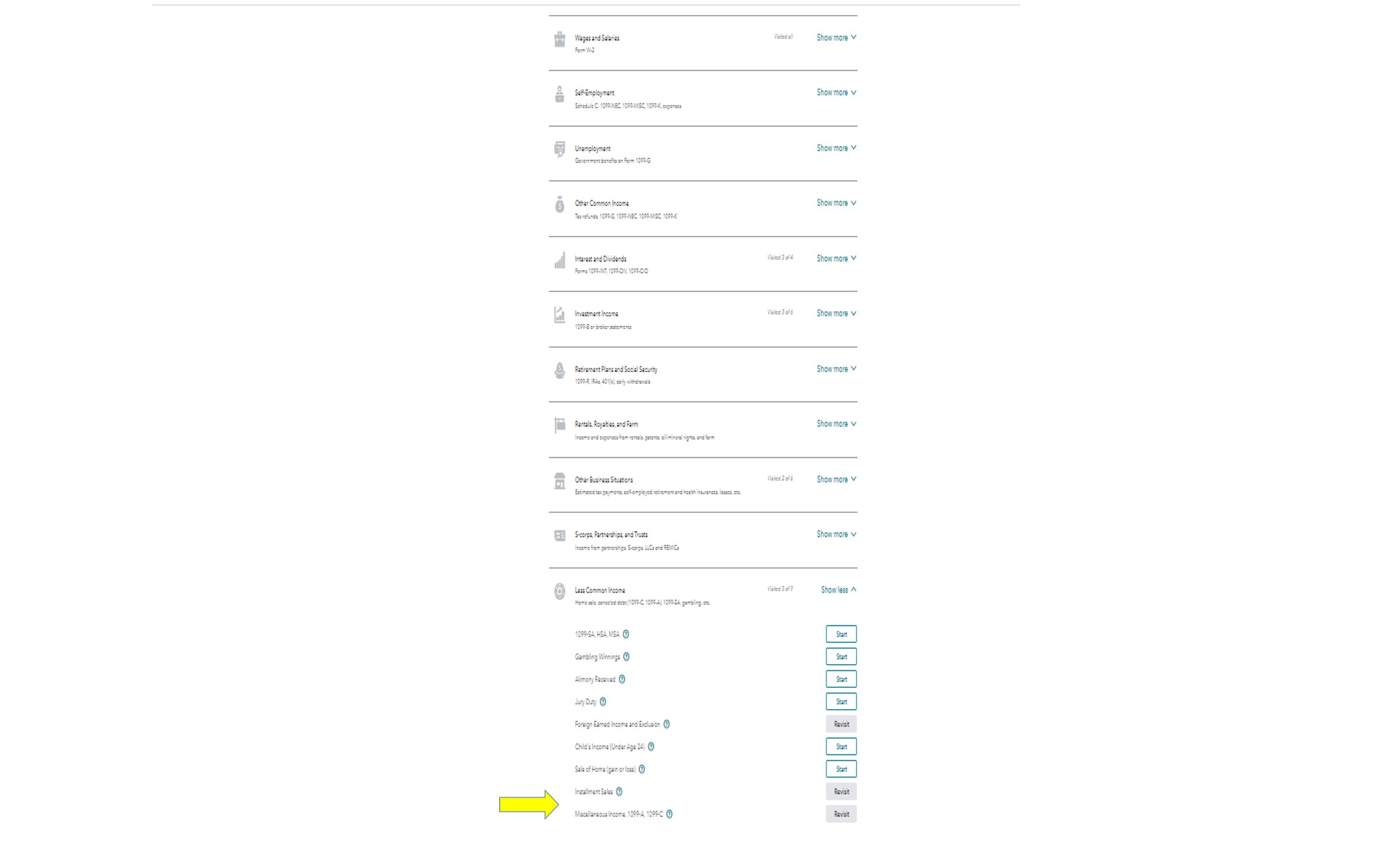

- Click on Wages & Income

- Scroll down to All Income

- Scroll down to Less Common Income

- Scroll down to Miscellaneous Income, 1099-A, 1099-C

- Click start

- Scroll down to Other reportable income

- Answer yes Enter description and amount

To report the US tax paid:

- With your return open

- Click on Deductions & Credits

- Scroll down to Estimates and Other Taxes Paid\

- Click on Other Income Taxes

- Scroll down Other Income Taxes

- Click on Withholding not already entered on a W-2 or 1099

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

I got all the answers how to put the numbers from 1042s to 1040 on turbotax. But here's a big problem to all these answers: 1042s clearly states that you need to attach it to your tax return, but turbo tax don't even allow you to attach any extra documents to your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report both W-2 and 1042-S form using Turbo tax free?

It's easy to put the numbers, but the problem is how to attach the form 1042s?

As 1042s clearly states that you should attach it to any tax return you are going to fill.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

doug1953cp

New Member

amarvin1

New Member

chinyen28

New Member

AJSR111

New Member

angryandbroke32

New Member