- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calcul...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

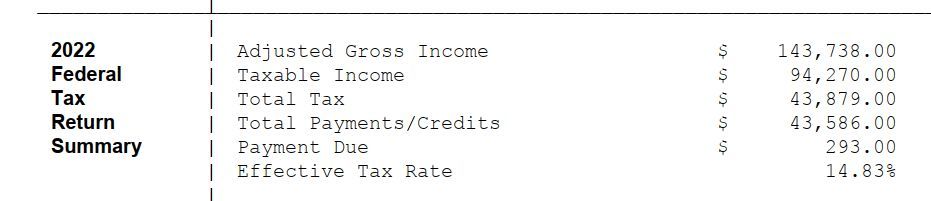

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

A blended tax rate, also known as the effective tax rate, is arrived at by any number of factors. The effective tax rate for individuals is the average rate at which their earned income, such as wages, and unearned income, such as stock dividends, are taxed. If you received income from a variety of things like stocks and bonds, interest, dividends, wages or self-employment, this may all play a role in determining your blended tax rate.

It's a calculation based on overall income and the amount of tax calculated on the tax return and is not specifically a marginal or capital gains tax rate.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

Also to clarify, when I divide my Total Tax into AGI, it also does not check out. I can't divide any number on my summary into any other number to yield "effective tax rate".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

Effective tax rate is something Turbo Tax uses to help see where you stand, see which w2 is deficient, etc. It should be the tax divided by the total income, not the AGI. It is a number without any real value other than just to let you know when you earn $1, about x% is taxed.

For more effective information see:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

I agree that it *should* be the tax divided by the total income, but it's not. That is the point the original poster is making. The calculation shown on the summary page just seems to make no sense.

So how, exactly, does TurboTax calculate the effective tax rate shown on the summary page? Because it appears to be wrong. Which does not instill confidence in customers.

We are not looking for an explanation of what effective tax rate means. We get it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

The Effective Tax Rate is not as simple as that, and is not intended to be. You may have some income that was taxed at 15%, some at 20%, etc. It is just an 'average'.

Although the figure is "nice to know" since we have a graduated income tax system it is really not part of the income tax return so although TT gives you the number they do not show you the computation.

Click this link for more info on Effective Tax Rate.

Here's more discussion on Effective Tax Rate noting various ways of calculating.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

I was able to duplicate TurboTax's Effective Tax Rate (ETR) using the following formula:

ETR = (Total Tax - Other taxes including self-employment tax) ÷ AGI

Why it is calculated as above (rather than ETR = Total Tax ÷ Taxable Income) remains a mystery to me, but I am not a tax expert. In my opinion, excluding self-employment tax from the calculation for people with self-employment income makes ETR a meaningless (and misleading) number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

based on the line numbers for 2022 returns the % is based on line 22 divided by AGI. in other words the % excludes other taxes on schedule 2. but the total tax shown is from line 24

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

@JohnnyC99 - the effective tax rate is attempting to determine the effective INCOME tax rate.

The taxes on schedule 2, including the Self-Employment Tax (which is really Social Security and Medicare tax) are not 'income' taxes; they are not based on the income or capital gains tax brackets but rather other formulas (NIIT=3.8%, SE = 15.3%, excess medicare .9%, 10% or 25% penalties on early IRA withdrawals, etc.). It doesn't include medicare or social security off the W-2s, so it shouldn't include SE Tax, which is the same thing.

the income is received from all sources; taxable income is reduced by the standard or iitemized deduction which is rather arbitrary and doesn't reflect all the money i brought in.

personally, I'd like to see it include all my taxes, including my state tax, my social security and my medicare tax, so i get a better picture of how much of my income I am paying out in taxes. But TT chose to display the effective tax on income and capital gains only; it is somewhat misleading and not very helpful. What is more helpful is just stating my tax bracket.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

Mike9241 has the correct answer regarding how TT calculates the ETR. It appears that TT doesn't follow the standard formulas for this calculation. TT DOES use AGI to calculate ETR, but the tax used for the calculation is from line 22, not the total tax from line 24. I was able replicate TT's ETR following Mike9241's answer. As others have pointed out, line 22 is only income tax, whereas line 24 includes other payroll taxes, including self-employment tax. For most working people, the actual level of taxation is best calculated from line 34 (total tax) divided by AGI. That gives you the actual percentage of your income that goes to Federal income and other taxes. The difference can be quite large. In my case, TT calculated an ETR of 9.43%. But using line 34 divided by AGI, the tax rate was 17.17%. I did not report any substantial interest or other income; it's all pension, social security, and contractor income. That makes the 17.17% total more accurate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

There a couple of things that you have to understand. First and foremost, NOT ONLY the effective tax rate calculation as described

HERE goes into the tax calculated on Line 16, Sometimes there is a long term capital gain rate from the sale of stock/ capital gains distribution etc with an attached Sch Capital gain calculation tax worksheet summary that gets included in that tax

In other words, even if your effective tax rate was 19,416 based on your taxable income on an ordinary tax rate. You may still have capital gain tax rate which is only taxed at 15% while if it was a short term capital gain , then you would have the excess of 83,550 taxed at 22%. In addition, there are other taxes that get added to the tax calculation like self employment tax, lump sum distribution from an IRA (Form 4972), Parent's election to report child's income etc. that gets added to line 16 to eventually get to the calculation derived on Line 22.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

They should just do away with that Effective Tax Rate because it's meaningless without more info on that page. I've been complaining about it for 30 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

I agree. I can get the TT number on my return when I use the line 22 tax. Turbo Tax should include a worksheet that shows the calculation and values used.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please explain how the "effective tax rate" on the Turbo Tax federal return summary is calculated. When I divide my Total Tax into Taxable Income, it does not check out.

Exactly right. Ignoring the self employment tax is ignoring what is the biggest chunk of many peoples tax burden

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

1099erGirl

Level 3

dlaing1

New Member

TaxPrep85

New Member

likungchuen

New Member

ualdriver

Level 3