- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When importing from Quicken, it want to import State and tax refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

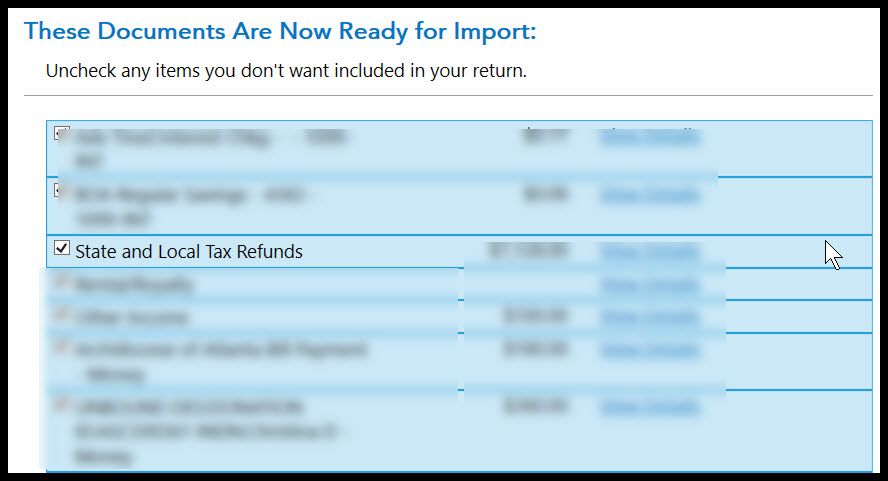

When importing from Quicken, it want to import State and tax refund

When importing from Quicken, it want to import State and tax refund.

Do I need to import that? It's a tax refund from last year, is it counted as revenue?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When importing from Quicken, it want to import State and tax refund

In quicken it tell in tax schedule report, that it's 1099-g. I don't know if that is required to fill?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When importing from Quicken, it want to import State and tax refund

You state refund is taxable only if you itemized in 2018. If you itemize your deductions, you are able to deduct state and local taxes. Therefore, if you receive a refund of those taxes, it becomes taxable income on your Federal return in the subsequent tax year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

RogerB-AZ

New Member

MarkLM

New Member

Jewing2

Level 1

SG835

Returning Member

evanwwong@gmail.

Level 1