- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

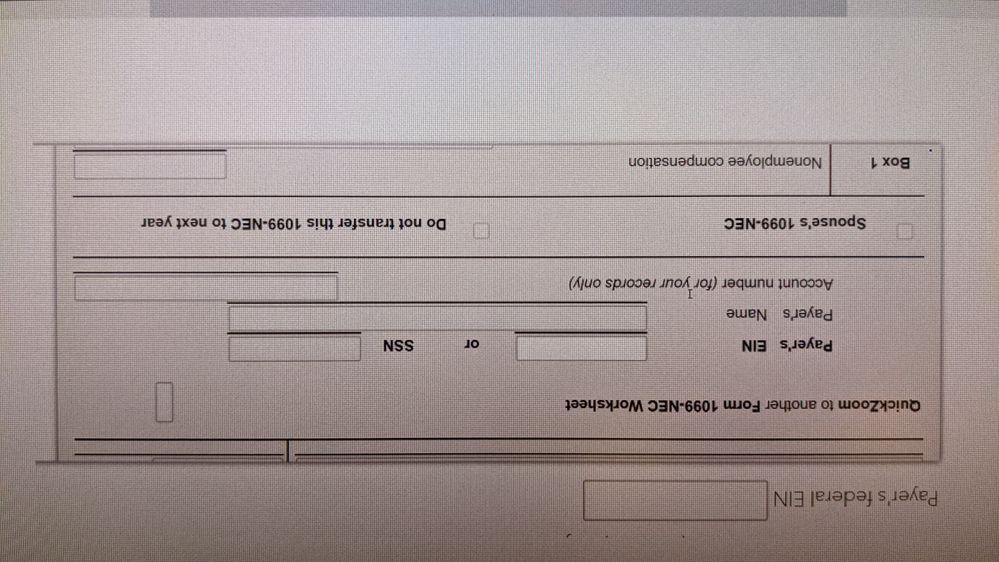

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

Then it displays a mostly grayed out Form 1099-NEC with my name and social autofilled at the top. Next it has a box labeled Payer's EIN, and next to it says or SSN and an empty box. For self employment shouldn't I be putting my SSN there? Why can I not click to fill that box instead?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

No, you do not enter your Social Security number on Form 1099-NEC as the payer. The payer information is for the company or entity who paid you for your services as a self-employed person. You are the recipient of Form 1099-NEC, not the payer.

You should only be entering Form 1099-NEC if you actually received the form showing your self-employed earnings from a company who paid you. If you did not receive Form 1099-NEC, then enter your self-employment income as 'cash' income on your Schedule C for your self-employed business.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

I am having the same issue, but the roadblock is that the federal income check function is flagging "missing information" and demanding the payer's EIN in the pop-up window under "Check this entry". This is after I selected the SSN option and provided the payer's SSN when inputting this income in the income section. The

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

If you are using TurboTax Desktop, you can go into Forms mode and enter the missing information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

I am using the online version. Is there a similar option? I have put them in during the input of income info, but TT Online is not carrying it forward and during the federal check the info is not there and it won't let me input it. Help please!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

My recommendation for TurboTax Online is to go to the dark border area on the left of your screen and select Tools, Tax Tools, Delete a Form and delete the Form 1099-NEC. Then go back into the Income & Expense, Self-Employment to re-add the 1099-NEC. Do Not add the Form 1099-NEC under Other Common Income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

This didn't work for me.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

VB27

New Member

juansepellegrini

New Member

needtaxhelp808

New Member

RMClark55

Level 2

imthetaxman1

Returning Member