Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Filling in income before and after I became a resident

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling in income before and after I became a resident

I arrived in Canada and became a resident in August 2023. I had income in my hometown throughout the year. When filling out the tax form, how can I separate the input of the income before and after I arrived? As the income I earned before I arrived should not be taxable, I believe it is crucial to separate them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling in income before and after I became a resident

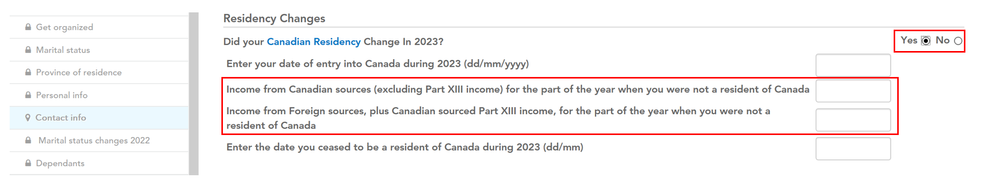

For the portion of your income that you earned when you were not a resident of Canada, go to the contact info page and enter the amount under Residency Changes section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling in income before and after I became a resident

Hi Jessica,

Thank you for your reply. Does this mean I need to convert the salary income into Canadian dollars and input it in the section you mentioned?

Do I also need to input this amount again in the:

(1) "Foreign Slip" section under "Employment Income" and "Enter the portion of foreign income exempt under a tax treaty"? Or is this section only for the foreign income I earned after I arrived in Canada?

(2) "Paid income tax to a foreign country" -> "Foreign tax credit - non-business" -> "Tax treaty exempt amount"? ***FYI- I have already done the tax clearance with my home country before I came to Canada.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling in income before and after I became a resident

Hello passernkl,

"(1) "Foreign Slip" section under "Employment Income" and "Enter the portion of foreign income exempt under a tax treaty"? Or is this section only for the foreign income I earned after I arrived in Canada?"

This is for foreign income you earned after you became a resident of Canada

"(2) "Paid income tax to a foreign country" -> "Foreign tax credit - non-business" -> "Tax treaty exempt amount"? ***FYI- I have already done the tax clearance with my home country before I came to Canada. "

Same as (1), this is for foreign income you earned after you became a resident of Canada. You don't need to enter anything here if it is related to income you earned before you became a resident of Canada.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling in income before and after I became a resident

Hi Jessica,

Appreciate your prompt reply!

(1) I had foreign employment income after I became the resident of Canada. So I am gonna fill in that amount in the "Foreign slip" under "Employment income". But what do I need to input for the "Enter the portion of foreign income exempt under a tax treaty"?

(2) For"Paid income tax to a foreign country" -> "Foreign tax credit - non-business" -> "Tax treaty exempt amount", what do I need to input? I have already done the tax clearance with my home country before I came to Canada so I no longer a tax resident of my home country according to my understanding. So I haven't paid any income tax to my home country for the employment income I earned after I arrived Canada.

Thanks you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling in income before and after I became a resident

Can Jessica or anyone from Turbotax help on this?

Thanks.

Related Content

eshropshire

New Member

QuestionTaxSpouse

New Member

Corndogger77

New Member

Altenblpc

New Member

mandy_2320

Returning Member