Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- How do I know if I qualify for the GST/HST rebate?

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Announcements

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I qualify for the GST/HST rebate?

posted

April 13, 2023

7:51 AM

last updated

April 13, 2023

7:51 AM

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I know if I qualify for the GST/HST rebate?

As per the Canada Revenue Agency (CRA), you are generally eligible for the GST/HST credit if you are considered a Canadian resident for income tax purposes the month before and at the beginning of the month in which the Canada Revenue Agency makes a payment. You also need to meet one of the following criteria:

- you are at least 19 years old

- you have (or had) a spouse or common-law partner

- you are (or were) a parent and live (or lived) with your child

In most cases, all you have to do to receive the GST/HST credit each year is file your taxes, even if you have no income to report.

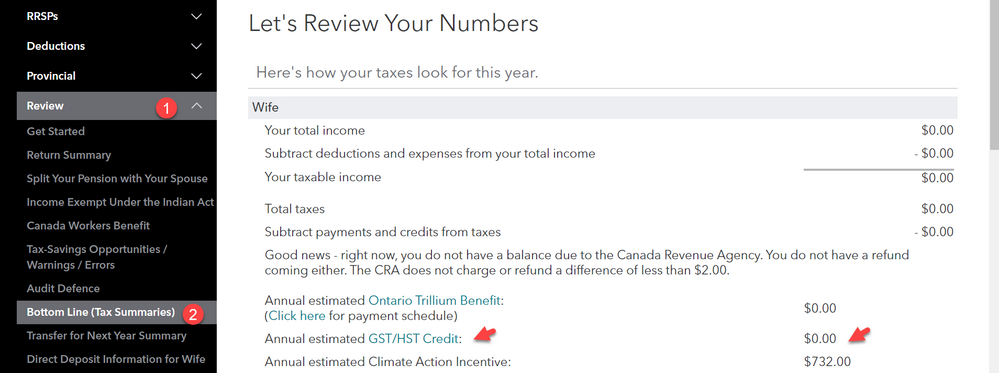

To verify the GST/HST Credit you may be receiving in your return please see the image below on how to go to see the Bottom Line (Tax Summaries).

Thank you for choosing TurboTax.

April 17, 2023

9:48 AM

Unlock tailored help options in your account.

Related Content

jessklahm

New Member

debsw1

New Member

anadyak

New Member

vanthuynejen

New Member

tenwall21

New Member