Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Norther resident deduction - travel

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Norther resident deduction - travel

for 2022 the CRA allows a travel deduction which is the lowest amounts of the following:

1. either the taxable travel benefits you received from employment

for the trip or the portion of the $1,200 standard

amount for the person travelling

2. the amount of the fare paid

3. the cost of the lowest return airfare available at the time of the

trip

I enter a portion of the $1200 standard amount in chart A box B and then fill in the amount for the airfare paid and lowest return airfare in Chart B columns 4 and 5 respectively. The amounts from Chart A Box B should transfer to column 3 of Chart B but do not. This results in no trip deductions being calculated. I believe in previous years there had to be a travel allowance on your T4 to claim a trip deduction, but this is no longer required. I'm not sure if the T4 amount is the trigger for Turbotax to calculate a deduction, but this should not be the case

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Norther resident deduction - travel

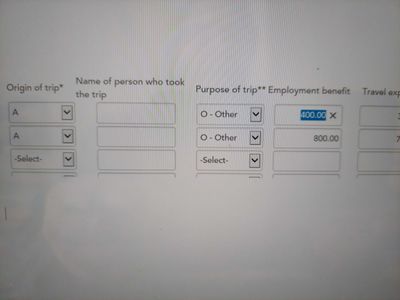

I found a work around so that turbotax calculates the trip deductions. In addition to entering a portion of the $1200 standard amount in Chart A, I also entered the portion of the standard amount for each trip in the column "Employment Benefit" even though the standard amount is not an Employment Benefit.

Unlock tailored help options in your account.

Related Content

jonransom

New Member

peytondawnm

New Member

Alixprestidge

New Member

dale-hannigan

New Member

robinnstewart663

New Member