Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Norther resident deduction - travel

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Norther resident deduction - travel

for 2022 the CRA allows a travel deduction which is the lowest amounts of the following:

1. either the taxable travel benefits you received from employment

for the trip or the portion of the $1,200 standard

amount for the person travelling

2. the amount of the fare paid

3. the cost of the lowest return airfare available at the time of the

trip

I enter a portion of the $1200 standard amount in chart A box B and then fill in the amount for the airfare paid and lowest return airfare in Chart B columns 4 and 5 respectively. The amounts from Chart A Box B should transfer to column 3 of Chart B but do not. This results in no trip deductions being calculated. I believe in previous years there had to be a travel allowance on your T4 to claim a trip deduction, but this is no longer required. I'm not sure if the T4 amount is the trigger for Turbotax to calculate a deduction, but this should not be the case

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Norther resident deduction - travel

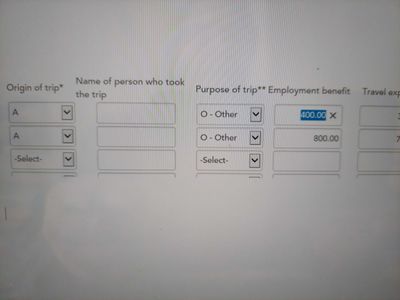

I found a work around so that turbotax calculates the trip deductions. In addition to entering a portion of the $1200 standard amount in Chart A, I also entered the portion of the standard amount for each trip in the column "Employment Benefit" even though the standard amount is not an Employment Benefit.

Related Content

dale-hannigan

New Member

robinnstewart663

New Member

Yukonuck

New Member

rhughes2

Returning Member

Fishplate12

New Member