Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Notice of Reassessment: Got charged for US income [new comer]

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Notice of Reassessment: Got charged for US income [new comer]

Hi everyone,

Thank you so much for reading my post and let me just say that I appreciate any help I could receive here.

I am an international student currently studying in BC. I came to Canada last September. Prior to that, I worked in US for the rest of 2022. I have a W2 (US income slip), filed 1040 and was a US tax resident.

I also filed tax in Canada for 2022. And my account decided that I should file as a Canadian resident because I have a rented apartment, a SIN, and moved here since Sept 2022 (signifcant tie I guess).

So I filed Canada 2022 tax as a tax resident, reported my US income in 2022 and claimed them as tax-exempt on line 25600.

I got a notice of assessment asking me to explain that line. So I uploaded my W2 (income slip), my US tax return, my US apartment lease, my Canadian apartment lease, my school enrollment letter and my student permit with border crossing date on it, trying to prove that I worked and paid tax in 2022 for most time and I should not be taxed on my US income based on tax treaty.

Then I got the letter of reassessment, asking me to pay tax on my US income. The tax I paid in US becomes foreign tax credit and I owe CRA money now.

I have did some research and asked my account, some other friends. The current plan seems to be:

1. Call CRA at [phone number removed] first thing on Monday and tell them my situation again. Try to convince them that I should not be taxed on my US income, as a Canadian tax resident for 2022.

2. If that doesn't work, call again to say I made a mistake filing as a Canadian tax resident. I was actually a non-resident for 2022, considering most of my ties were in US in 2022, and I just moved to Canada in September just for school. Had 1 apartment and knew no one in Canada.

3. If that doesn't work either, I don't know. I know I can file an objection to the reassessment (and the max number of objection you can file is 9?). OR I can electronically use the "change my return" option in my CRA account (not sure what I can change there) try to "amend" my return by myself?

My questions are:

Do you think I have a winning chance given my situation and everything I have provided to CRA? What should I focus on my call to CRA, the tax treaty, the wrong residency status, escalating? Should I find another account or CPA to fight this on my behalf? And should I pay the amount owe first to avoid more interest.

Thank you so much for any type of suggestions and I apologize ahead of time if any of my descriptions come across as offensive, stupid or something else.

Thank you.

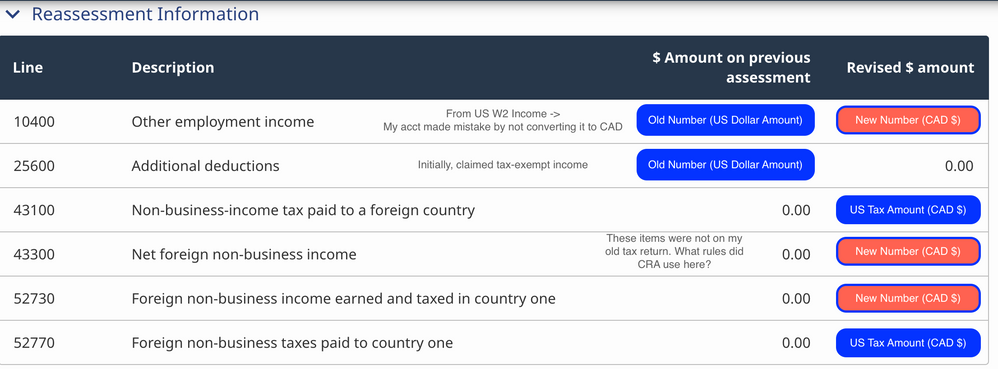

Reassessment Information: now "New NUmber" become my total and net income to be taxed on.

Related Content

WhiteLight

New Member

HelpME2020

Returning Member

warnerph

New Member

conwaga

Returning Member

Jim_B

Level 1