Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: Clarification required on spouse income

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Clarification required on spouse income

Hi,

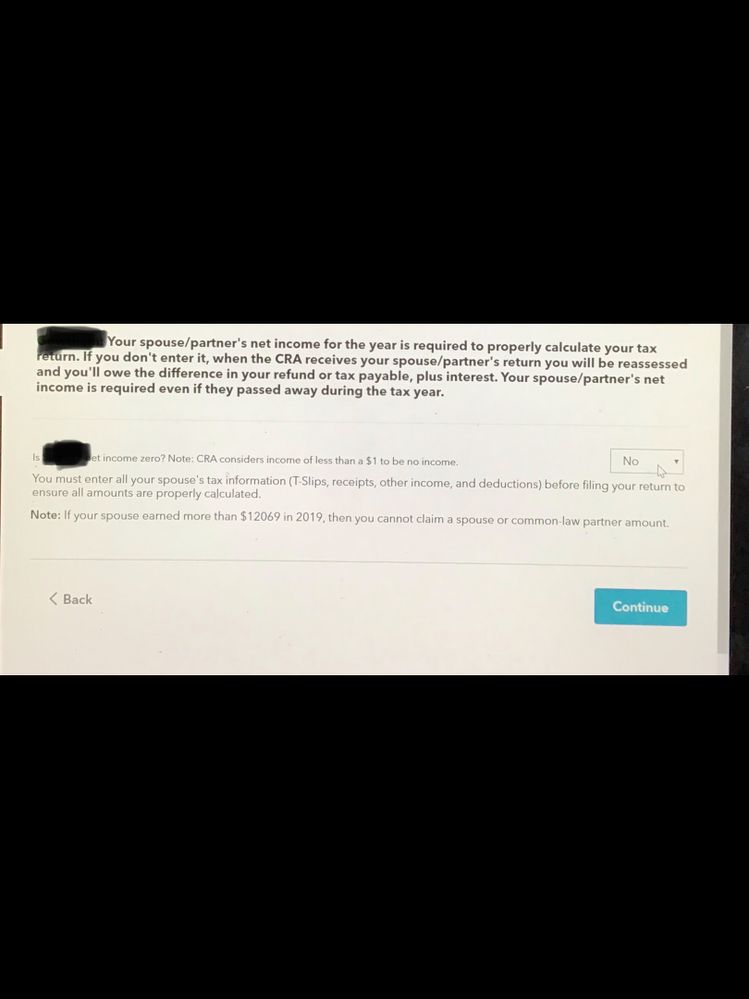

me and my spouse are filing tax together. She moved to Canada in mid of 2019 and is not employed here. But she was working in home country and that gross earnings have been mentioned in foreign income section.

for below question, should I mention YES as my spouse net income in Canada is 0 or should I mention NO because of home country income ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Clarification required on spouse income

Assuming she was not a resident of Canada when she worked overseas and never worked in Canada, you would be correct in recording her Canadian Income as zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Clarification required on spouse income

Thank you for the clarification, this helps.

Can you also validate if my understanding is correct on below point ?

Her overseas gross income when not resident of Canada should only be mentioned in her ‘Canadian residency change’ page under foreign sources income and not anywhere else (like foreign tax credit section)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Clarification required on spouse income

You are correct as she would not be receiving a foreign tax credit as she was not a resident of Canada. Please see additional information below from the CRA website regarding non-resident tax obligations:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Clarification required on spouse income

Thank you so much.

Related Content

QuestionTaxSpouse

Returning Member

TheRealJoNay

New Member

Altenblpc

New Member

NKatz5

Returning Member

gazzarini

Level 1