Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: Filling in income before and after I became a resident

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling in income before and after I became a resident

I arrived in Canada and became a resident in August 2023. I had income in my hometown throughout the year. When filling out the tax form, how can I separate the input of the income before and after I arrived? As the income I earned before I arrived should not be taxable, I believe it is crucial to separate them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling in income before and after I became a resident

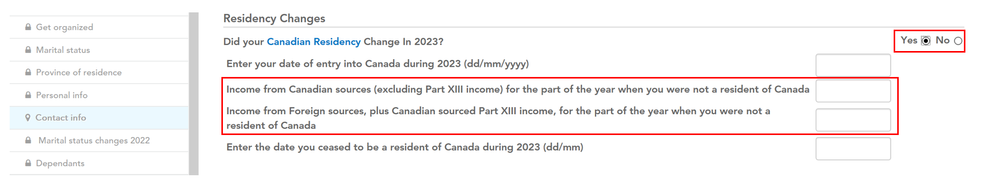

For the portion of your income that you earned when you were not a resident of Canada, go to the contact info page and enter the amount under Residency Changes section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling in income before and after I became a resident

Hi Jessica,

Thank you for your reply. Does this mean I need to convert the salary income into Canadian dollars and input it in the section you mentioned?

Do I also need to input this amount again in the:

(1) "Foreign Slip" section under "Employment Income" and "Enter the portion of foreign income exempt under a tax treaty"? Or is this section only for the foreign income I earned after I arrived in Canada?

(2) "Paid income tax to a foreign country" -> "Foreign tax credit - non-business" -> "Tax treaty exempt amount"? ***FYI- I have already done the tax clearance with my home country before I came to Canada.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling in income before and after I became a resident

Hello passernkl,

"(1) "Foreign Slip" section under "Employment Income" and "Enter the portion of foreign income exempt under a tax treaty"? Or is this section only for the foreign income I earned after I arrived in Canada?"

This is for foreign income you earned after you became a resident of Canada

"(2) "Paid income tax to a foreign country" -> "Foreign tax credit - non-business" -> "Tax treaty exempt amount"? ***FYI- I have already done the tax clearance with my home country before I came to Canada. "

Same as (1), this is for foreign income you earned after you became a resident of Canada. You don't need to enter anything here if it is related to income you earned before you became a resident of Canada.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling in income before and after I became a resident

Hi Jessica,

Appreciate your prompt reply!

(1) I had foreign employment income after I became the resident of Canada. So I am gonna fill in that amount in the "Foreign slip" under "Employment income". But what do I need to input for the "Enter the portion of foreign income exempt under a tax treaty"?

(2) For"Paid income tax to a foreign country" -> "Foreign tax credit - non-business" -> "Tax treaty exempt amount", what do I need to input? I have already done the tax clearance with my home country before I came to Canada so I no longer a tax resident of my home country according to my understanding. So I haven't paid any income tax to my home country for the employment income I earned after I arrived Canada.

Thanks you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filling in income before and after I became a resident

Can Jessica or anyone from Turbotax help on this?

Thanks.

Unlock tailored help options in your account.

Related Content

parthdhand2

New Member

digitalnilesh

Returning Member

jassalmohit900

New Member

rask4p

New Member

durkeemk

Level 2