Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: For Turbotax 2020, what happened to the "Foreign income - T4 slip, box 72" field?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For Turbotax 2020, what happened to the "Foreign income - T4 slip, box 72" field?

I am a Canadian TN Visa holder working in the US on behalf of a Canadian Company. I am paid in Canadian Funds. In previous years, I file my US Taxes with a 1040NR because I am in the US for more than 6 months out of the year. I then claim the US taxes I paid in my Canadian Tax Return using Form T2209.

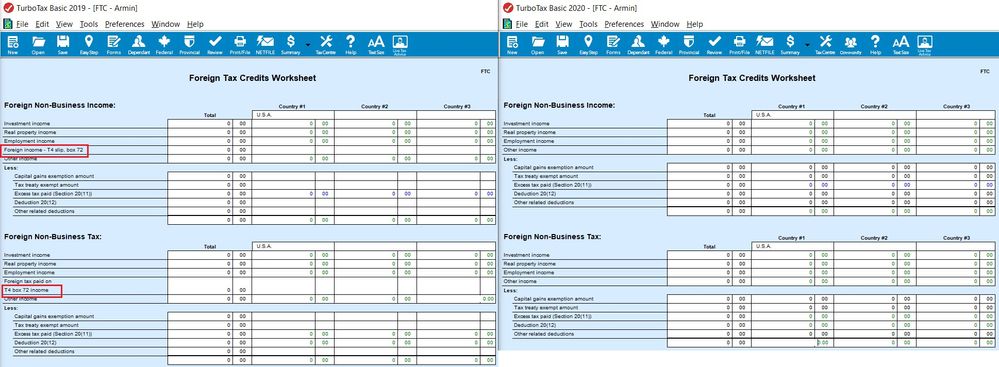

However, the field in my TurboTax 2020 software where I normally enter this is no longer there. This was present in all previous versions of the software. See screenshots.

How do I proceed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For Turbotax 2020, what happened to the "Foreign income - T4 slip, box 72" field?

Hi I have the exact same problem. All of my income is reported on my T4 yet I paid US tax using 1040NR.

In years past (2018, 2019) the FTC sheet worked correctly if I used the box 72 entry.

This year if I enter it as "other income" it adds that to my Canadian Income reporting it higher than it actually was.

If I only enter the tax paid, it doesn't carry the credit portion to the worksheet.

The only way I found to make this work is to complete the FTC Worksheet, which populates the T2209, and then delete the "Other Income" line from the T1 General, which then makes the return unable to be filed using Net File as I did an Override.

If someone can suggest a way to make this work so that I can net file that would be greatly appreciated.

Related Content

Ukemi

New Member

user78

New Member

fnttax

New Member

Peter91

New Member

curtishilgersom-

New Member