Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: T4A Box 48

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T4A Box 48

My T4A was autofilled to my return through the CRA download but when I fill out the self employment section and manually add the amount of income it doubles the income amount. If I leave it blank the income amount in box 48 does not register at all as if no T4A existed. The final result is a refund when I know I owe tax on the box 48 amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T4A Box 48

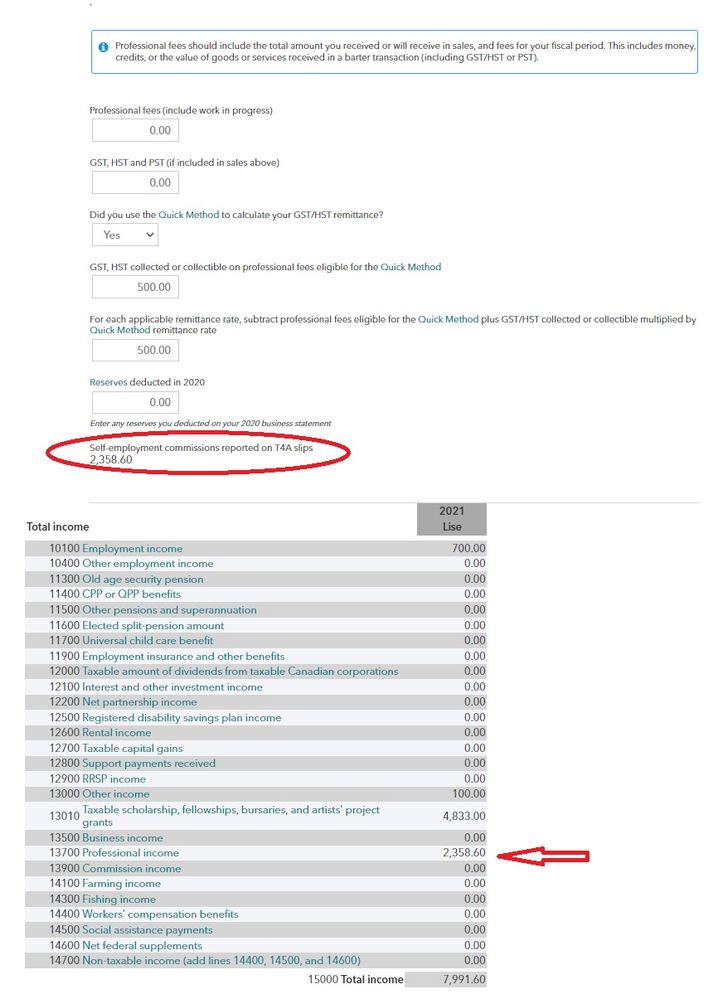

In the online edition of the software, once you have entered your T4A box 48, it brings you to the next page asking if you have self-employment income to enter you say "yes" then move through the additional screens, you will get to the screens shown below:

Screen one is your SE entries, where it shows you the amount from your T4A box 48 when applied

Screen two is the Detailed Tax Summary page that shows you the entry for that slip.

You do not need to enter it on the SE screen, it automatically applies when you enter the T4A box 48.

Same applies when you use the downloaded version of the software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T4A Box 48

I have a similar question. I am not self-employed so I did not check any box. I did Charity work and recieved a T4A - filled out box 48 in the correct program area, but nothing filtered thru to box 13500 automatically. This got caught by CRA, now I have more income and a penalty. Was there a question I should've answered differently? Nothing came up as an error?

Unlock tailored help options in your account.

Related Content

abphd

New Member

brianlyne

New Member

jrowling

New Member

dixius99

Level 1

Adria1

New Member