Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: Tuition Transfer - two children

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tuition Transfer - two children

My children's tax returns indicated that they have for one, the max amount of $5k to transfer and the other, an amount of $926 to transfer. So I should see an amount of $5,926 on my return based on this. However, my return is indicating the amount is $5k which is the cap per child so it appears that it is not recognizing the available transfer amount from the second child. The amount is hard coded based on the T2202 inputs so how can I correct this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tuition Transfer - two children

Further to the above, I have sufficient room to use the full deduction so that is not the issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tuition Transfer - two children

In order to assist you properly, can you tell us which version of TurboTax you are using; Online or Desktop?

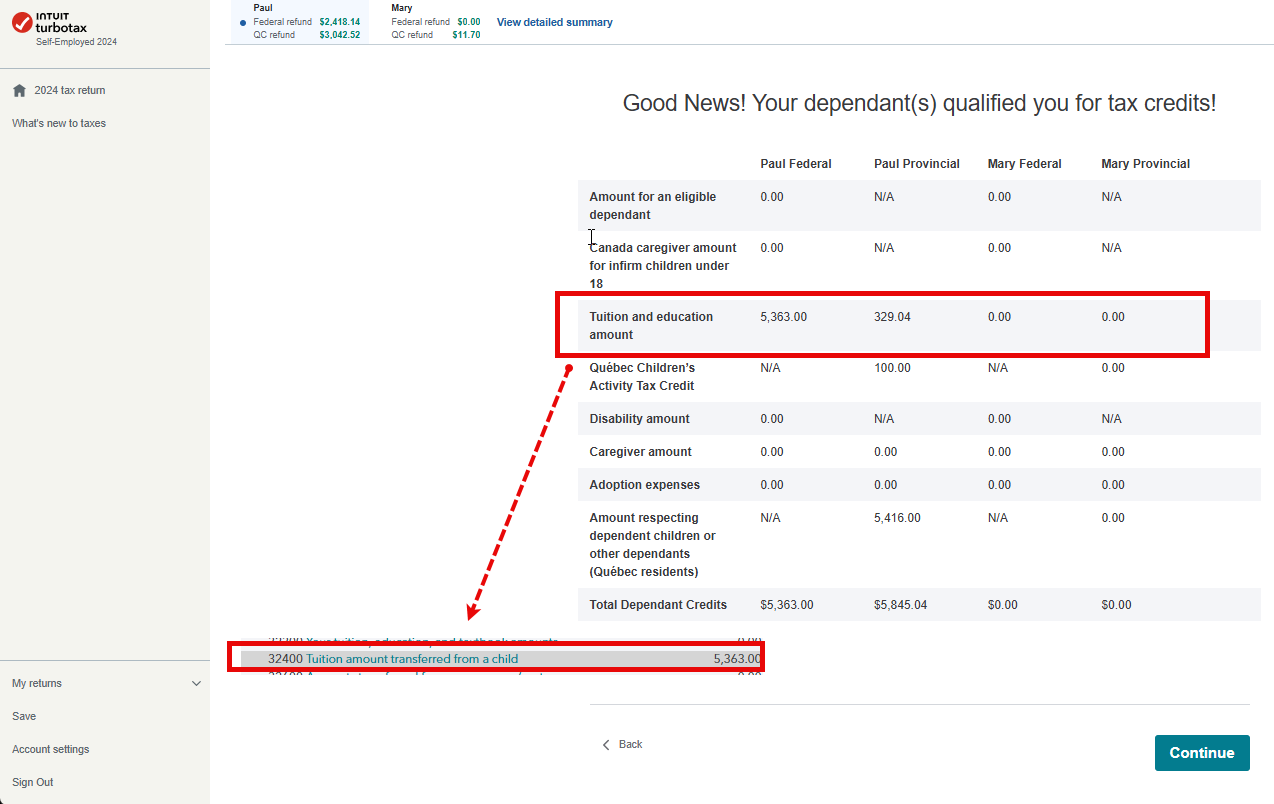

We made some tests in TurboTax Desktop and it should work properly. As you can see on the following screenshot, when the information for both dependents is entered in Dependent section, we can see it on the Tuition transfer worksheet and then on line 32400 of the T1.

Same for TurboTax Online, it should work. You have to make sure in Additional Dependent information, you clicked yes to the question about student // you have to make sure you applied credit for each dependent.

We suggest you to review your entries.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tuition Transfer - two children

Hi I am using the online version. Both dependents have the box checked for tuition transfer and both have their amounts entered from Schedule 11 of their individual returns. Yet somehow only the tuition transfer amount from one of their returns is showing up. Is it possible to take this offline and demonstrate what i'm seeing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tuition Transfer - two children

Given this doesn't work and the non-reply to my question I'm moving my returns to a competing software.

Unlock tailored help options in your account.

Related Content

jonasraymond

Returning Member

MC373

Returning Member

jtcraw

New Member

chloe-guinaudie

New Member

Malibu2

New Member