Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Credits & deductions

- :

- Hi An amount was added on line 434 (additional contribution for child care) on my wife's assessment. How can i adjust mine to reflect that change?

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi An amount was added on line 434 (additional contribution for child care) on my wife's assessment. How can i adjust mine to reflect that change?

Topics:

posted

December 4, 2019

7:02 AM

last updated

December 04, 2019

7:02 AM

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi An amount was added on line 434 (additional contribution for child care) on my wife's assessment. How can i adjust mine to reflect that change?

Hi, thank you for using Intuit turbotax Live Community

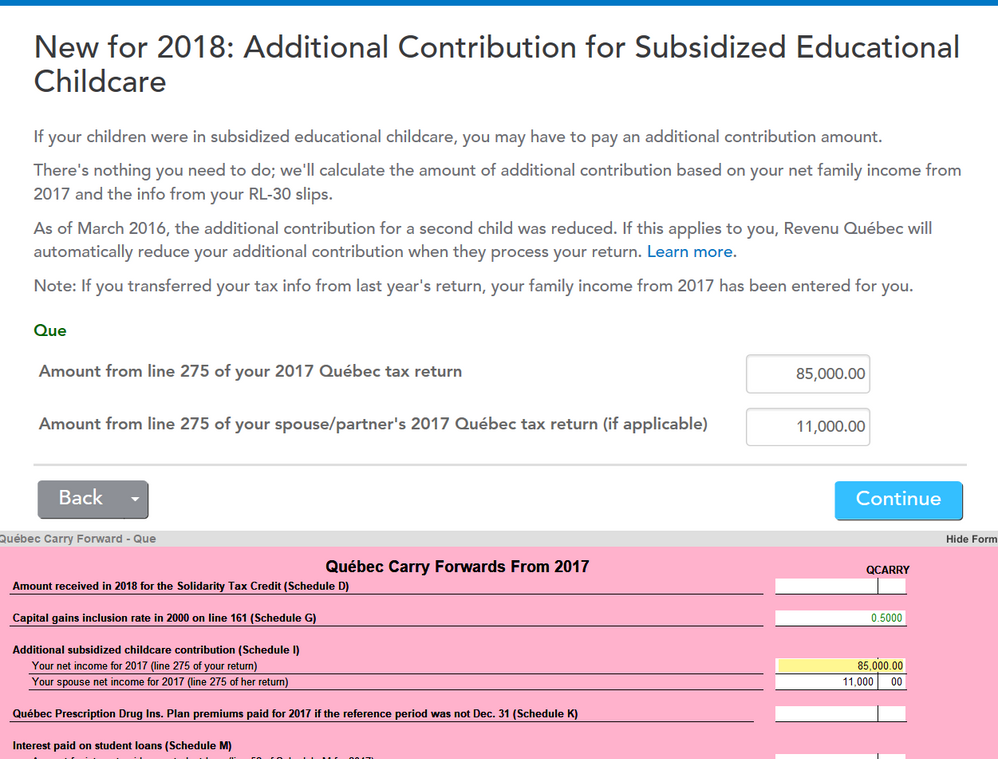

The amount on line 434 of the Quebec TP1 is calculated on the TP1 schedule I. TurboTax, in addition to entries for dependant(s), would prompt for entries on:

1) RL 30

2) RL 24 and

3) Entries for prior year line 275 income:

These three entries are required for TurboTax to calculate the amount for line 434 of the TP1.

If I were to guess, 3) is likely the issue needed to match Ministry of Revenue(MRQ). But, review entries for all three.

Hope this helps

December 4, 2019

10:50 AM

Related Content

rdonko197708

New Member

joquestion

New Member

lindsay-marshall

New Member

gtbruce

New Member

cad9falcon

Returning Member