Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Credits & deductions

- :

- Re: How/where do I enter charitable donations?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How/where do I enter charitable donations?

I'm filing for 2021 using the free online software version. I am trying to figure out how to enter charitable donations. I figure this would be something I could do without upgrading (as I've been able to do in the past).

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How/where do I enter charitable donations?

How/where do I enter charitable donations?

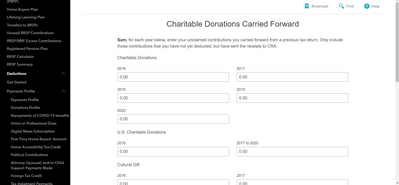

In EasyStep, click on the "Find" icon on the toolbar. Search for "Donations" in the Index tab and click "Go". It will go to the "Donations profile for 2021" page. You can check the "Unclaimed donation contributions carried forward from a previous tax return". Click on "Continue" will land on the "Charitable donations carried forward" and you can enter info there.

See Below:

Please Check out this Canada Revenue Article: How do I calculate my Charitable donations

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How/where do I enter charitable donations?

But that is only for previous years (2016-2020) not for this past year (2021)

Why is it that this year they decided to lock this feature when it has always been included with the free version? (or at least it has been for the past 5 years that I have been doing my own taxes)

Can the Turbotax team please make this available to us? It's as if turbotax is trying to make money off the people that are being charitable and giving... which just isn't great PR.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How/where do I enter charitable donations?

I think I will be doing my taxes elsewhere as their services are still free for inputting charitable donations. (they also have the CRA's autofill feature (with NETFILE) which is convenient)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How/where do I enter charitable donations?

This year, TurboTax is taking extra steps to ensure that Canadians have access to the features that will help them get the best tax outcome by broadening its product line up and directing users to the version of TurboTax that aligns with their tax situation. We’ve expanded our lineup and tailored each version of TurboTax to address the complexity of various levels of filers. This year, when you file with TurboTax, you will be directed to the version that best suits your needs based on complexity, to ensure you are getting the best possible tax outcome for the best value.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How/where do I enter charitable donations?

If I am correct, what you're saying is that anyone who wishes to claim charitable donations must pay to upgrade their version of TurboTax?

So for example: If I had the most basic tax return (let's say I have a single simple T4) and the only other thing I did was donate to a charity, I would have to upgrade my version of TurboTax?

As mentioned by a previous comment @Davemonunn , the charitable donation section was offered for free, but now it is not. You do understand how this looks, don't you? That TurboTax is profiting off of people who generously give to charities.

People who give out of their own pocket now to have pay to claim those donations.

@TurboTaxGinette Greedy much?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How/where do I enter charitable donations?

We appreciate your feedback, and we will be sure to forward this to the proper TurboTax department.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How/where do I enter charitable donations?

I too encountered the same issue. I have been using the free online version for years and the minute I try to claim a charitable donation I am faced with having to pay to upgrade after getting 90% through a basic return.

This is corporate greed at it's finest and looks very bad for TurboTax. I strongly suggest you change this feature to be included in the free version as a 'charitable' gesture/feature.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How/where do I enter charitable donations?

To answer my own question; yes, they are greedy. See the news from their U.S. department: https://www.cnbc.com/2022/05/04/turb[product key removed]t-to-pay-141-million-to-customers.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How/where do I enter charitable donations?

This is BS. Why do we have to pay to enter our charitable donations. Won't be back !!!!

Related Content

TE27

New Member

donawalt

New Member

jgreene3

New Member

randhzimmy

New Member

carmen-birtwistl

New Member