Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Credits & deductions

- :

- Work-Space-In-The-Home Expenses - Area vs. Rooms

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work-Space-In-The-Home Expenses - Area vs. Rooms

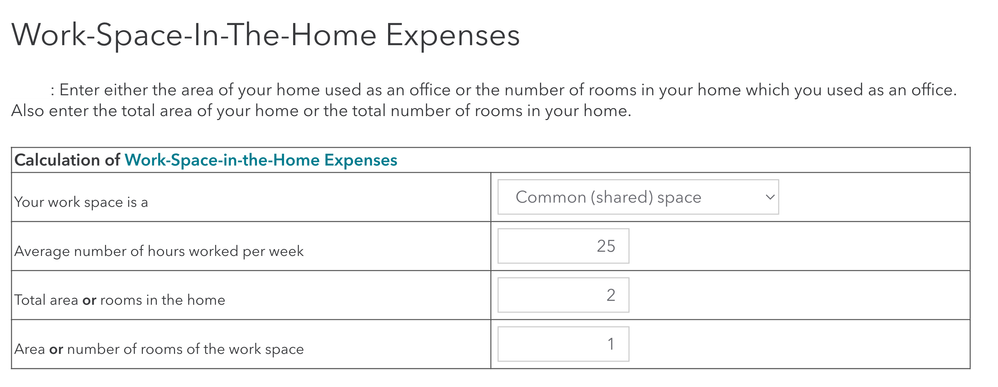

I work from home over 50% of the time and have received a T2200 from my employer. My desk is in my bedroom (I assume that makes it a common/shared space) . We have a 2 bedroom apartment.

My question is regarding the discrepancy I get in allowable deduction (almost $700) from when I state total rooms (2) and number of rooms of the work space (1) vs. total area (900) and area of the work space (80).

Should I be doing one over the other - is rooms only useable for dedicated space?

CRA does not speak to rooms.

Screen shot provided.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work-Space-In-The-Home Expenses - Area vs. Rooms

The Canada Revenue Agency (CRA) advises to use use common shared space in this link Types of work spaces as the room is used for added purposes in the home. Unfortunately, this way of calculating and the amount allowed for the expense will vary quite a bit.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work-Space-In-The-Home Expenses - Area vs. Rooms

Thank you. So are you saying I am okay to move forward stating 1 room out of 2 vs. square footage calculation? I only see the square footage formula on the CRA website and the T777 form itself, nothing in reference to total rooms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work-Space-In-The-Home Expenses - Area vs. Rooms

If the Canada Revenue Agency (CRA) ever verifies your claim, they may reassess and ask you to claim only the footage as the room is being used for other purposes than work. The link that was supplied above indicates they prefer you claim by footage in your case.

Thank you for choosing TurboTax.

Unlock tailored help options in your account.

Related Content

maria_cristina_pavel

New Member

mark-vukas

New Member

jeff

New Member

valeriemacneil

New Member

chanellelize

New Member