Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Filing, printing, post-filing

- :

- Filing

- :

- How to fill T766 to claim depreciation of my rental property

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

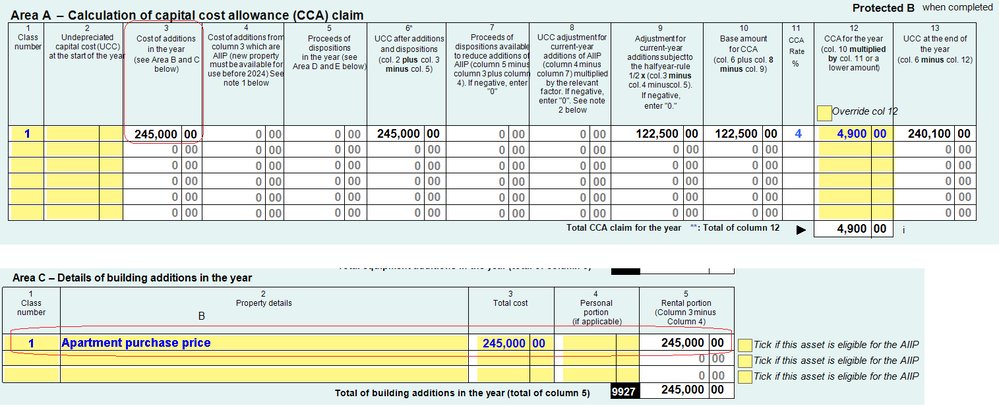

How to fill T766 to claim depreciation of my rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fill T766 to claim depreciation of my rental property

If you are entering it as an addition for this year, you need to enter the value of the property as is it is for this year, not from when you bought it.

You can also go back to the year you bought it and adjust your return for that year to add the property at the original price. If you choose not to take depreciation for that year (or the years in between) then you can just put the end UCC balance from the 1st year as your starting balance for this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fill T766 to claim depreciation of my rental property

Got you Susan.. I may have to adjust my previous returns...

Also, I just noticed that every year you would claim less than the previous year because it is 4% for the remaining balance... For example, if it is 100k to begin with, then in the first year I can deduct 400. The next year I can only deduct (10k-400)*4%=384, and the year after will be (10k-400-384)*4%=368.64. Does it sound about right? thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fill T766 to claim depreciation of my rental property

Yes, that's correct.

Related Content

milly101

Level 1

CathyTrottier

New Member

darehshoori

New Member

dubnikov

Level 1

difan

Level 1