Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Filing, printing, post-filing

- :

- Filing

- :

- Re: Short term disability

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term disability

I have received short term disability pay through my union because I had hip surgery.Do these earnings have to be put in as income on my taxes? No tax was taken off.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term disability

If you receive benefits from a Wage Loss Replacement Plan such as Short-Term Disability (STD), Long-Term Disability (LTD), or Weekly Indemnity (WI), you will receive a T4a and report these amounts on Line 10400 of your tax return.

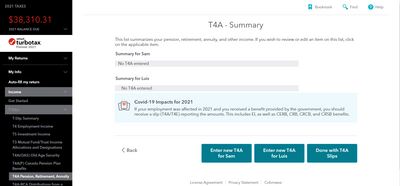

How do you enter a T4A slip for the TurboTax online edition:

- Select the image of the magnifying glass (or Find) in the upper-right area of TurboTax.

- Enter “T4A” in the Find window.

- Select T4A Pension, Retirement, Annuity from the list of results, and then select Enter new T4A.

- Enter your amount to box 107.

See Below:

Please check out the Canada Revenue Agency article: Wage loss Replacement Plan

Thank you For choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term disability

The union said I will not get a T4 or any form because no tax was taken off.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term disability

So would I have to claim the income from the payments?

Unlock tailored help options in your account.

Related Content

KevinHollis

Level 1

WendyMcAlpine

New Member

Jlemxx12

New Member

hydradon

New Member

rebecca_sgro

New Member