- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am using TurboTax Online Self-Employed 2023. Where do I enter payments made to subcontractors? There is no option for this in the business expenses section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

To enter subcontractors' costs you use the Inventory section of the T2125. This screen is found directly after the Business Income section. Enter your subcontractor costs on the line marked "Subcontracts : Enter all the costs of hiring outside help to perform work related to the goods you sell."

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

I do not see this window. Could you please show me a screenshot of the page?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

Thank you. I cannot find this page to save my life. Is there a box I should have selected previously in order to get it to populate? On my screen after I finish with income, it goes directly into expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

You have to answer “Yes” to the question “Did you sell products that you bought or manufactured?” to see the inventory section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

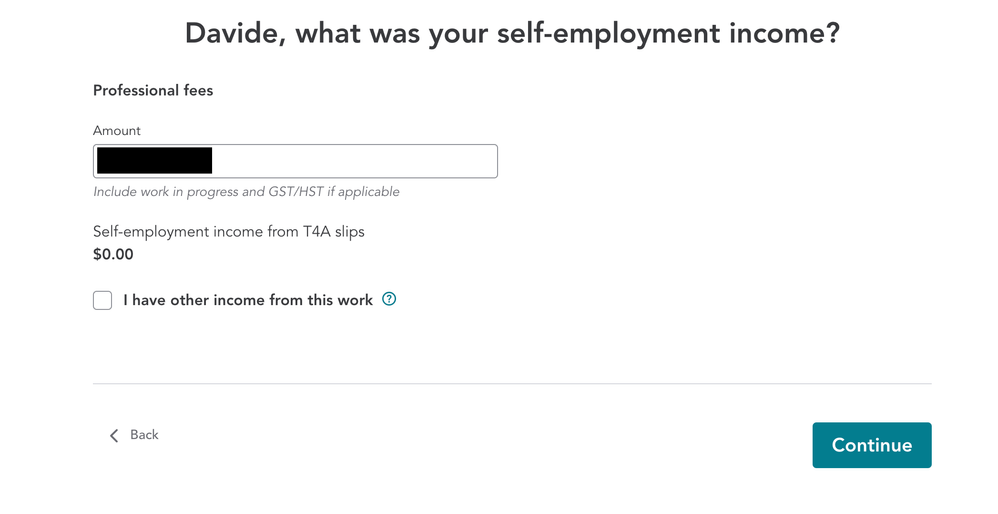

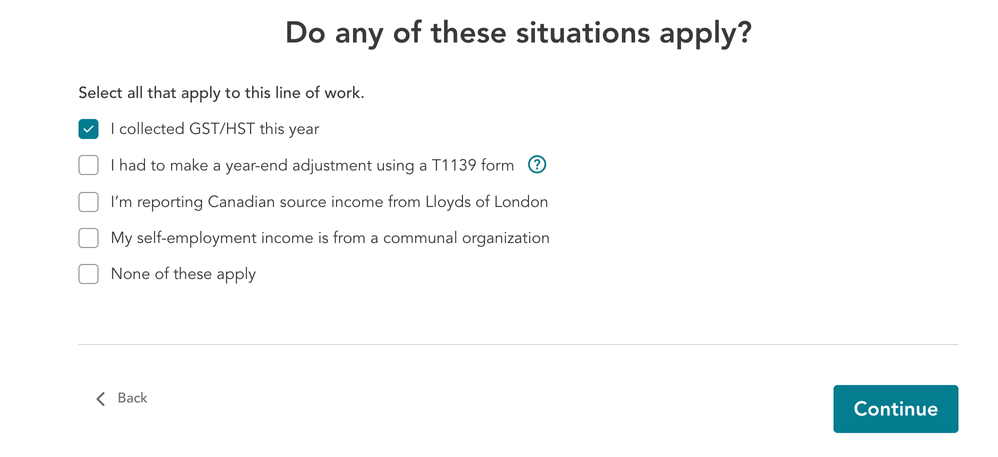

Thank you Susan. I'm so sorry but I don't get that page. This is what comes up for me. After I click continue on the self-employment income page, it brings me to the "Do any of these situations apply" page. After I input the GST information, it brings me to the income summary, and then after I click continue it brings me to the expenses section. No mention anywhere of inventory or subcontractors.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

Can you please confirm which type of work you do as self-employed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

It seems that you may have chosen "Professional" instead of Business under "What category is your self-employment work?" This is why you see differently then we have have shared. If this is the case, you will need to delete the business and enter a new business- making sure to choose "Business" and not professional as your work category.