- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

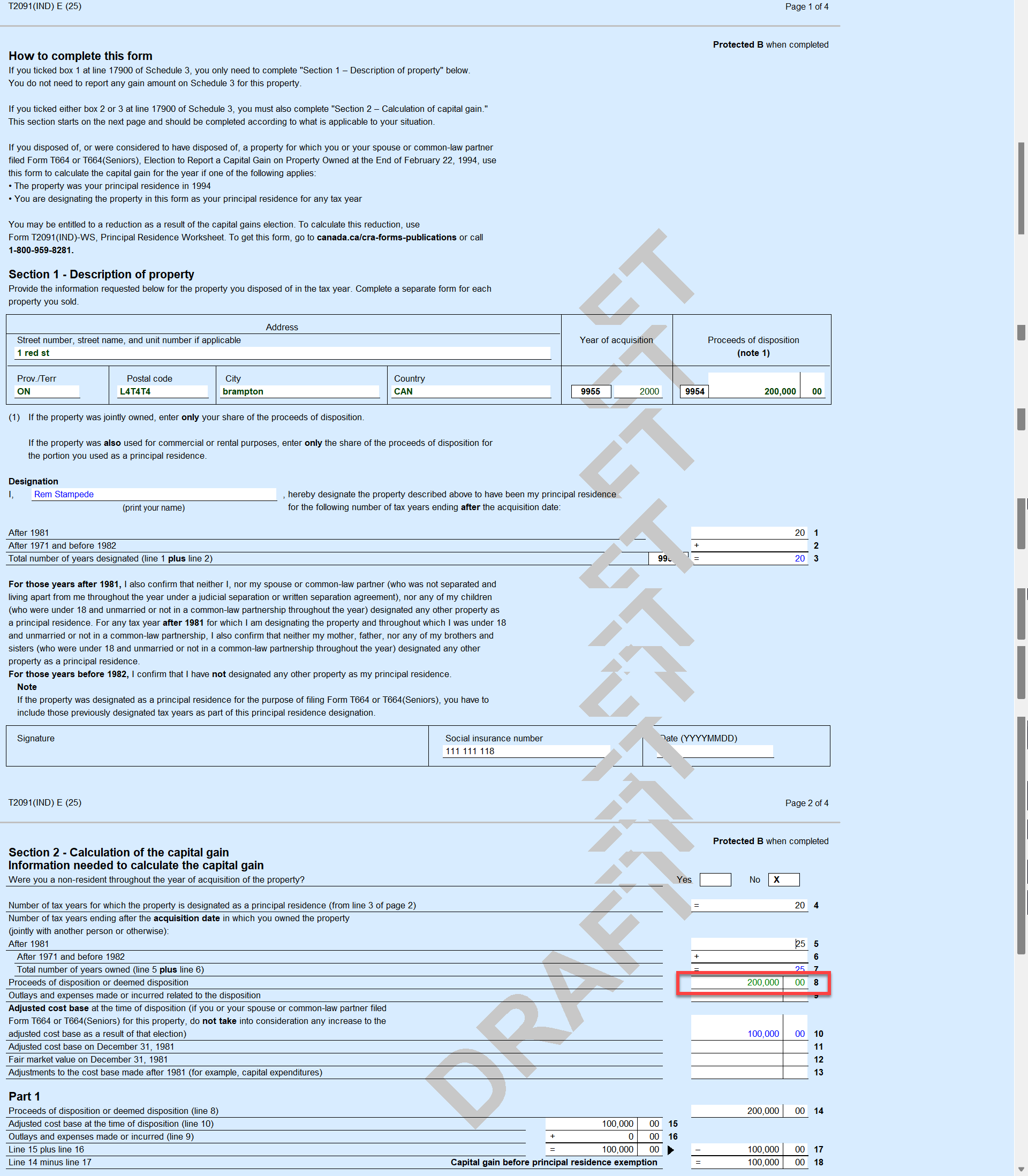

Yes, you will have to split the Adjusted cost base and Proceeds of disposition.

If the T2091 isn't calculating properly, please make sure that you've filled out the PRWS & T2091 completely, including the year purchased and the years owned/principal residence.

Note: If the whole home was your principal residence the entire time you owned it, then you won’t have capital gains (or losses) due to the sale.

January 11, 2026

2:00 PM