Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Importing your data

- :

- What box 105 do i enter my grant?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What box 105 do i enter my grant?

I was considered a full-time student for 12 months according to my T2202A and paid $3000 in tuition for those 12 months. For my t4A I have an amount of $6000 that I received as a grant. I am unsure what 105 boxes to enter my grant in. I was getting very confused reading things online saying you need to take into account the costs and $500 exemption and now I am lost. What box do I enter this grant!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What box 105 do i enter my grant?

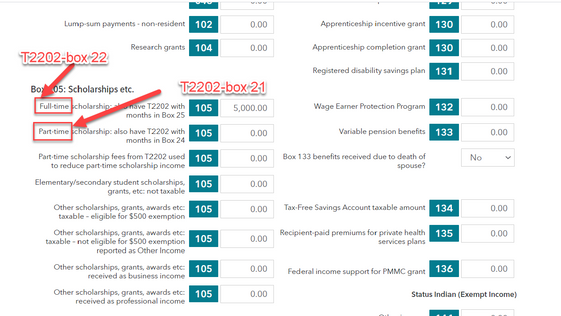

If you received a grant (box 105 of a T4A), report it as scholarship income in one of the first two options (full-time or part-time whichever the case may be). On your T2202, Box 21 will specify if you were a part-time student, and Box 22 will specify if you were a full-time student. Since you were considered a full-time student, you would enter the Box 105 amount in the spot for full-time students on the T4A screen (Full-time scholarship: also have T2202 with months in Box 25).

The attached photo below will indicate where to input the amount:

Related Content

kayla_hickey-hot

New Member

Ayad1

Level 1

terry1229

New Member

kickapoojoyjuice

New Member

Picto242

New Member