Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Investments & rentals

- :

- Re: How to fix the error message: "To accurately calculate your capital gains, you need to enter ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix the error message: "To accurately calculate your capital gains, you need to enter a date of disposition in 2024 on your T5008 slip(s)." I entered the dates?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix the error message: "To accurately calculate your capital gains, you need to enter a date of disposition in 2024 on your T5008 slip(s)." I entered the dates?

Are you using the online or desktop version? Check every T5008 slip entry to ensure that each transaction has a valid disposition date within the 2024 calendar year. Ensure that the date entered is in the correct format. Date of Disposition (dd/mm/yyyy).

I also recommend deleting the slips and reentering them. If you are using a desktop version, make sure it's up to date.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix the error message: "To accurately calculate your capital gains, you need to enter a date of disposition in 2024 on your T5008 slip(s)." I entered the dates?

Thank you for the reply. I am using the online version. I have more than 570 slips. reentering it manually is impossible. I used the connect to CRA and download the T5008 Slips as is from CRA account as reported by the broker. Also I manually checked all the files twice. Is there a way to delete the slips and reenter it from the CRA account?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix the error message: "To accurately calculate your capital gains, you need to enter a date of disposition in 2024 on your T5008 slip(s)." I entered the dates?

Yes, you can delete the imported slips from your online tax software and re-import them from your CRA account; however, with over 570 slips, you may encounter the same import issues as before.

Unfortunately, 570 slips from the CRA account cannot be imported. That's a large number of T-slips, which could cause a problem during importation. You must manually add all of the slips.

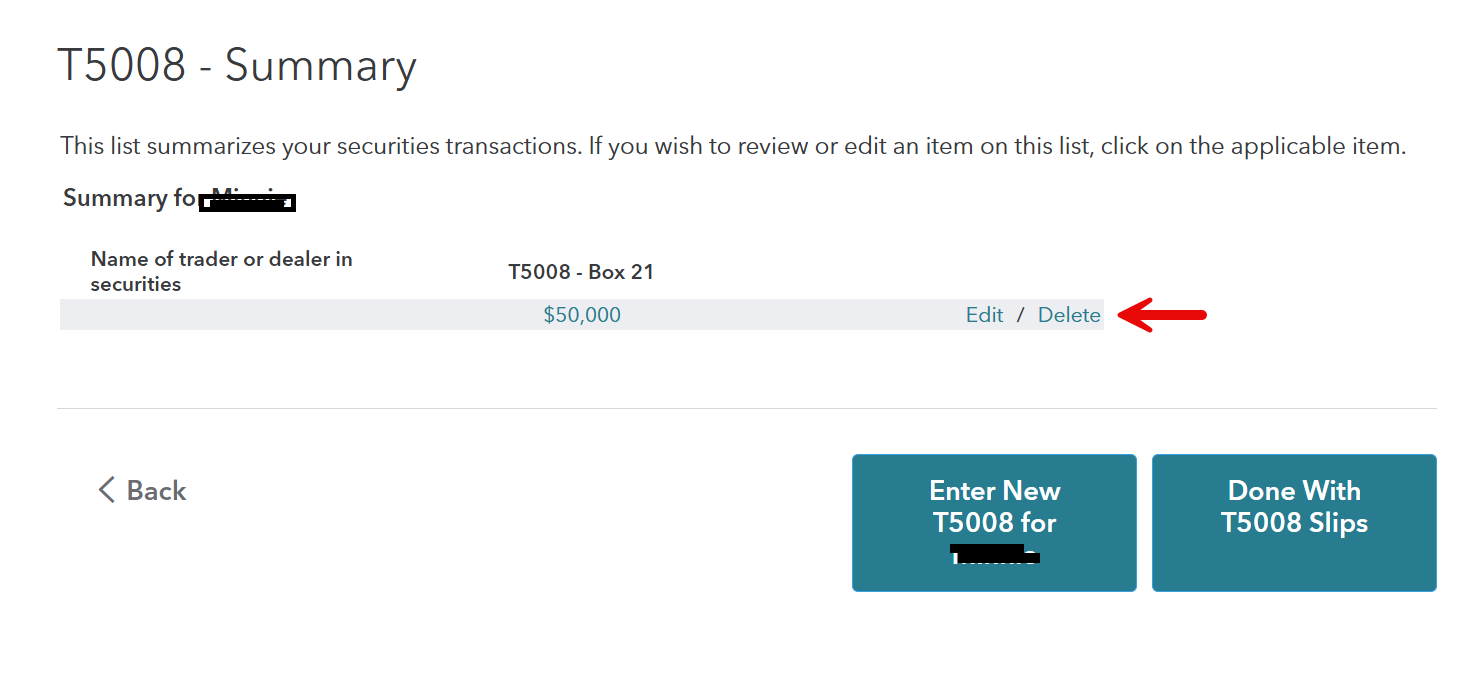

You may need to click an "Edit" or "View" button next to each T5008 entry and look for a "Delete" option.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix the error message: "To accurately calculate your capital gains, you need to enter a date of disposition in 2024 on your T5008 slip(s)." I entered the dates?

Worst software support I've ever dealt with. What a joke. Write a script to fix the problem. Stop being so cheap. I filled out the date for several hundred transactions and it still gives me the same error. Fix your software. Return my money. Boo. You suck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix the error message: "To accurately calculate your capital gains, you need to enter a date of disposition in 2024 on your T5008 slip(s)." I entered the dates?

This is nothing short of a joke. You should refund anyone having this problem or better yet hire some competent staff who can write better code. Why don't you just allow people to bypass the problem and send it to the CRA via netfile anyways? Do your job. Worst software ever.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix the error message: "To accurately calculate your capital gains, you need to enter a date of disposition in 2024 on your T5008 slip(s)." I entered the dates?

@user17674672086 Starting with tax year 2024, the disposition date is mandatory for the T5008, so you can’t file without one.

If you have many T5008, then instead of entering each individual one, you can group them together and then use December 31 as the date of disposition.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix the error message: "To accurately calculate your capital gains, you need to enter a date of disposition in 2024 on your T5008 slip(s)." I entered the dates?

I didn’t have the option to group slips and edit dates in the online version till December 2025. However this would have been really helpful. Past is past. But I have a suggestion. I am a UX designer and I have a solution to fix this user pain point. If you can connect me to the tech team I would be happy to discuss the fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix the error message: "To accurately calculate your capital gains, you need to enter a date of disposition in 2024 on your T5008 slip(s)." I entered the dates?

@abyphilipson Unfortunately there's no way to put you in contact directly with our product development team. But we do pass on customer comments and suggestions to them.

Unlock tailored help options in your account.

Related Content

abyphilipson

Level 1

jordan_tibbo

New Member

ramonahill

New Member

HatchS

Returning Member

MplCRA2019

Level 1