- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: UK Goverment Pension and Private Pension - Tax free in US or not?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

I’m confused by the varying information being posted about the the US tax liability of the payment of UK government Pensions paid to US Residents / Citizens. Different people seem to read article 17 and deduce different answers, so perhaps we can ask for the answer from those that have successfully filed.

If I may I would like to address the following situation:

- Full time residents / citizens receiving SS for both partners.

- UK government paid to both partners based on working contributions prior to moving to the US.

- Previous UK employer pension paid to 1 person

- US tax Basis, married filing jointly.

- UK basis no tax deducted from any pension.

- UK pension amounts declared to SS.

Depending on which opinion you read, article 17 is designed to avoid being taxed twice (UK+US) but I suspect most people interested in Article 17 pay no UK tax because of the amounts being below any UK tax threshold and or non-residency.

So, the questions are:

- Is a UK government pension not taxed in the UK subject to US tax liability or excluded under article 17?

- Does the same answer apply to private UK pensions (contributions from employee and employer?

- How is the pension correctly reported in Turbo Tax?

Where can you download a copy of article 17?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

To answer questions 1 and 2, the UK pension is subject to tax in the UK and not the US. This applies even though it may not be actually taxed in the UK because of any pensions exclusions there.

Article 18 of the UNITED STATES-UNITED KINGDOM INCOME TAX CONVENTION states: "...any pension in consideration of past employment and an annuity paid to an individual who is resident of a Contracting State shall be taxed only in that State [the UK].."

For question #3, to report the pension in TurboTax, report the full amount of the pension under the Social Security income section and then report the same amount (as a negative amount) as other income on line 21 of your 1040. You will also need to attach a form 8843 (which is not supported by TurboTax) to a file by mail copy of your return.

Please follow these steps:

- On the Wages & Income screen, scroll down to Retirement Plans and Social Security.

- Click the Start/Revisit box next to Social Security (SSA-1099, RRB-1099)

- Click the Yes box on the screen, Did you receive Social Security or Railroad Retirement benefits in 2019?

- On the Tell us about the benefits you received screen, enter the amount of your foreign pension in Box 5.

- Back on the Wages & Income screen, scroll to Less Common Income.

- Click the Start/Revisit box next to Miscellaneous Income, 1099-A, 1099-C

- On the next screen, click the Start/Revisit box next to Other reportable income.

- Click the Yes box on the Any Other Taxable Income screen.

- On the next screen, enter the amount of your pension as a negative number. For Description enter “UK pension offset” (or something similar).

The negative number will appear on line 21 of your return and will negate the entry for your UK pension.

To exclude your UK pension from taxable income, you will have to include Form 8833 - Treaty-Based Return Position Disclosure. Unfortunately this form is not available in TurboTax. Download the form from the IRS website, complete it, and include it with your return. [You will have to mail in your return.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

if you paid a foreign tax on your British pension, you can claim a foreign tax credit on your US tax return to avoid double taxation. To claim your foreign tax credit, please follow the guidelines written by one of our agents LinaJ2020 as she has listed detailed instructions. Follow these closely.

After this is entered, you will need to claim a foreign tax credit by doing the following:

- Click Federal >Deductions and Credits at the top of the screen

- Scroll down to Estimates and Other Taxes Paid and click on Show More

- Click on Start or Revisit next to Foreign Taxes and then select Yes

- Select Yes to the question "Have you already reported all of your foreign income?" and then click on Continue

- Select any applicable boxes to the question "Tell Us About Your Foreign Taxes" and then select Continue

- Then select "Take a Credit" to the question "Do You Want the Deduction or the Credit?" Select No to the question "Do all of the following apply to your foreign income?"

- Continue until you get to the section "Choose the Income Type" and then select the appropriate income category. Click Continue.

- Add the country and continue through the sections, answering any applicable questions. Keep going until you get to the section "Foreign Taxes Paid" and then enter your foreign taxes and the date. (See screen shot below)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

Yes, Foreign Pension income is taxable in the US. If you also paid Foreign Taxes on your pension, claim a Foreign Tax Credit on the tax paid.

If you have a 'government' pension from a foreign country, it may not be taxable in that country.

To report the foreign pension income, under Wages & Income, scroll all the way down to Less Common Income, then to Miscellaneous Income 1099-A, choose Start/Update.

On the next page, scroll all the way down to Other Reportable Income; choose Start/Update. On the next page, you enter a Description and Amount (screenshot).

To claim the Foreign Tax Credit, under Deductions & Credits, scroll down to Estimates and Other Taxes Paid; choose Start/Update for Foreign Taxes.

@shallathm

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

To answer questions 1 and 2, the UK pension is subject to tax in the UK and not the US. This applies even though it may not be actually taxed in the UK because of any pensions exclusions there.

Article 18 of the UNITED STATES-UNITED KINGDOM INCOME TAX CONVENTION states: "...any pension in consideration of past employment and an annuity paid to an individual who is resident of a Contracting State shall be taxed only in that State [the UK].."

For question #3, to report the pension in TurboTax, report the full amount of the pension under the Social Security income section and then report the same amount (as a negative amount) as other income on line 21 of your 1040. You will also need to attach a form 8843 (which is not supported by TurboTax) to a file by mail copy of your return.

Please follow these steps:

- On the Wages & Income screen, scroll down to Retirement Plans and Social Security.

- Click the Start/Revisit box next to Social Security (SSA-1099, RRB-1099)

- Click the Yes box on the screen, Did you receive Social Security or Railroad Retirement benefits in 2019?

- On the Tell us about the benefits you received screen, enter the amount of your foreign pension in Box 5.

- Back on the Wages & Income screen, scroll to Less Common Income.

- Click the Start/Revisit box next to Miscellaneous Income, 1099-A, 1099-C

- On the next screen, click the Start/Revisit box next to Other reportable income.

- Click the Yes box on the Any Other Taxable Income screen.

- On the next screen, enter the amount of your pension as a negative number. For Description enter “UK pension offset” (or something similar).

The negative number will appear on line 21 of your return and will negate the entry for your UK pension.

To exclude your UK pension from taxable income, you will have to include Form 8833 - Treaty-Based Return Position Disclosure. Unfortunately this form is not available in TurboTax. Download the form from the IRS website, complete it, and include it with your return. [You will have to mail in your return.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

Thank you for the concise answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

Should I enter the full amount of the UK pension reported as social security receipts, or only the (lesser) amount that actually flows througth to taxable SS income reported as part of AGI. In other words, should the net effect be zero impact on taxable income?

I don't undertand the comment about line 21. When I enter the negative number as “miscelleneous income” in Turbo Tax it appears on line 7a on Form 1040.

Thanks for your help!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

When reporting your income for US tax purposes you are required to report worldwide income, not just taxable income amounts.

You report the foreign pension income similar to the way you would report it if the income came from the US by using substitute 1099-R forms

Link to The Taxation of Foreign Pension and Annuity Distributions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

Good reply!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

On the Instructions for Form 8833 section Exemptions from reporting does it not say the reporting on form 8833 is waived for pensions, annuities, social security, etc? So must I file form 8833 for my UK social security and UK pension if I am an American resident in the UK?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

Is there any change to the Plus / Minus instruction from last year.. TT doesn't seem to handle it the same way.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

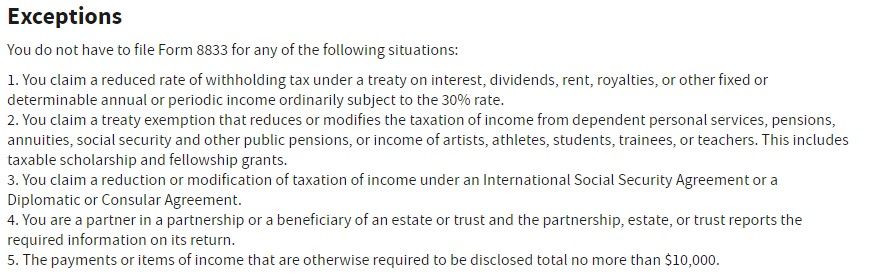

If you believe your UK pension is exempt, you should file the Form 8833.

Per instructions of Form 8833, page 3, the third column, it says:

"Positions for which reporting is waived include, but are not limited to the following.

That a treaty reduces or modifies the taxation of income derived by an individual from dependent personal services, pensions, annuities, social security, and other public pensions, as well as income derived by artists, athletes, students, trainees, or teachers;"

See image

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

Tax treaty-related matters are out of scope for our advice. Generally, the UK pension is taxable to the US. You would not file the Form 8833 Treaty-Based Return Position Disclosure However, some foreign pension might not be taxable if it is covered under any tax treaties between the foreign country and the United States. As it is out of our scope for advice, you are advised to consult a specialized professional for verification.

If the UK pension is not taxable to you,

- report your full amount as instructed below in the 1099R section. Then enter the treaty exempt amount as negative amount (e.g. -5000) under Other Reportable Income as instructed below.

- Download and fill in a Form 8833 from IRS to claim an exception. https://www.irs.gov/pub/irs-pdf/f8833.pdf

- You cannot e-file. You may still use the TurboTax program to prepare all your tax forms, but you would need to print them out and submit by mail along with form 8833.

If it is taxable, to enter the UK pension, you will need to create a substitute form 1099-R.

Here are the steps:

In TurboTax online,

- Sign in to your account and select Pick up where you left off

- At the right upper corner, type in 1099r, then Enter

- Select Jump to 1099r

- Follow prompts

- Next screen, Choose your bank or brokerage, select I'll type it in myself

- Follow prompts. On the screen Tell us if any of these uncommon situations apply

- Check the box I need to prepare a substitute 1099-R and follow the prompts.

As to the Federal ID, UK pensions often do not have the ID number. Please try entering nine 9s. If electronic errors occur due to 1099-R data entry, enter the pension under Miscellaneous income, see instructions below. As long as the IRS has the pension reported and included in total income, it is not problematic.

- To your left, select Federal

- From the top, select Wages and Income

- Scroll down to last section -Less Common Income -select Miscellaneous Income, 1099-A, 1099-C- Start

- Next screen, scroll down to Other Reportable Income- Start

- Follow prompts

For more information, see http://www.irs.gov/Businesses/The-Taxation-of-Foreign-Pension-and-Annuity-Distributions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

Thank you for those detailed instructions. I’m a dual US/UK citizen and US resident who now receives a UK State Pension from my years in UK. 2020 is my first year to file US taxes including a UK State Pension of less than $10,000. It's clear from IRS.GOV under Claiming Tax Treaty Benefits, point 5, that I don’t need to file Form 8833 since I’m under $10,000.

So my question is for “britgeezer” or anyone in the same position….

Is the UK State Pension really exempt under the US/UK Tax Treaty Article 17? and have you successfully filed using the Positive substitute 1099R and Negative miscellaneous income so well described by “LinaJ2020”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

Hi john12140

Dual status you say, from the US perspective when you became a US citizen and domiciled here – the US may not agree, but the British Government would, bless them.

I had the same decision to make last year and I gave the “income in and out” information to a tax preparer whom used it, I have to look and see if they filed an 8833. This year when I asked here there were different opinions ….

Did you mean $10K I don’t see that - not item 5 but its $100k. The document you reference is full of “IF” comments, we need a definitive statement.

Unless you kept your pension income in the UK why would you report the official UK amount, did you get that? I use the direct deposit received $ amount that various each month.

Since it’s a big influence on my US taxes (my wife and I both receive UK Government pensions), I have contacted 2 Expat tax services to see what they say. I suggest you do the same and we compare notes.

Run the UK pension amount through TT, that’s the $ amount at risk if it’s not deductible.

I’m asking CrossBorder Wealth and Experts for Expats, may I suggest you consult with someone else and we share the results.

If you will or do receive Social Security, as we do; I would love to compare some notes off line.

John

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

Thanks for that, on the Dual citizenship, my US passport even provides information for Dual citizens so it seems to be recognized now.

Yes, I’ll run TT without the negative amount to see what the impact is, I’m still waiting for some of the numbers. It won’t be much because I only got a few weeks UK State Pension in 2020. I’m not so concerned this time but I was hoping to establish how to proceed in future years. It would certainly cost me more to get professional advice than I would save for 2020.

On the $10K, see below from IRS.GOV:

John

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

IRS webpage about claiming tax treaty benefits

Of importance is #2 in the below quote from the above website. Of importance, no forms are required to claim the tax treaty exemption on pension payments.

>>>

Exceptions

You do not have to file Form 8833 for any of the following situations:

- You claim a reduced rate of withholding tax under a treaty on interest, dividends, rent, royalties, or other fixed or determinable annual or periodic income ordinarily subject to the 30% rate.

- You claim a treaty exemption that reduces or modifies the taxation of income from dependent personal services, pensions, annuities, social security and other public pensions, or income of artists, athletes, students, trainees, or teachers. This includes taxable scholarship and fellowship grants. ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UK Goverment Pension and Private Pension - Tax free in US or not?

Here is the UK - US tax treaty. Scroll through it until you reach article 17.

The US can tax the pension of a person who is a resident of the US unless the pension is exempt in the country of origin, since the person resides in the U.S. However if the pension is tax-exempt in the UK, it is also tax-exempt in the U.S.

And you are correct, no forms are required in this situation.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Yearlytax

New Member

glmonds

Level 1

pookie3

New Member

MiguelMtz

Returning Member

happikat13

New Member