Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Self-employed

- :

- I am self employed as a Massage Therapist and travel to and from work at a distance of 60km each way. Where do I claim expenses such as Gas, Car repairs?

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am self employed as a Massage Therapist and travel to and from work at a distance of 60km each way. Where do I claim expenses such as Gas, Car repairs?

posted

Thursday

last updated

April 10, 2025

4:24 PM

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am self employed as a Massage Therapist and travel to and from work at a distance of 60km each way. Where do I claim expenses such as Gas, Car repairs?

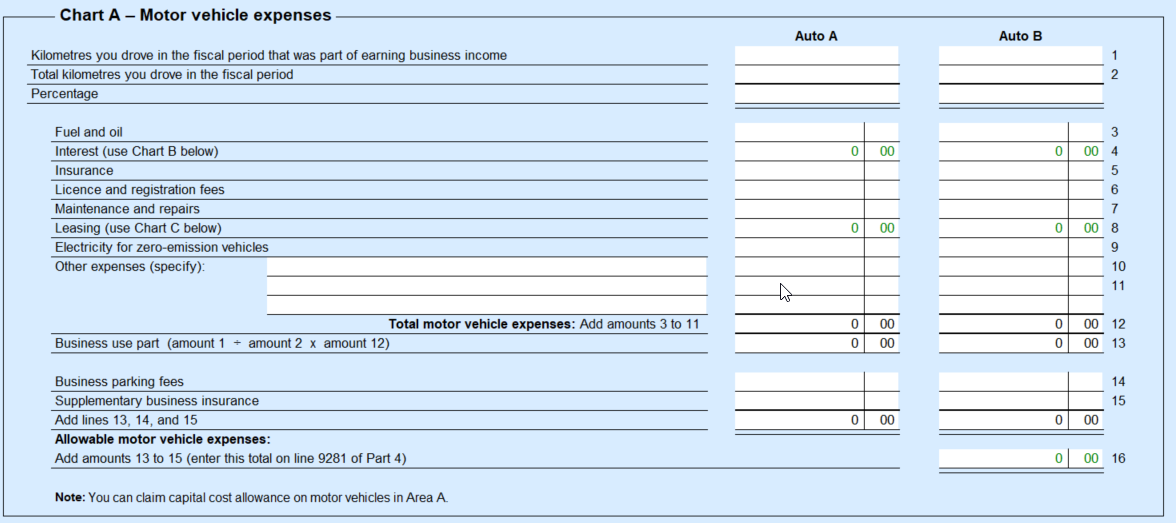

If you are using TurboTax Desktop, you should be able to enter all information about vehicle expenses in the T2125 form, page 9, under the Chart A section.

In TurboTax Online, in Self-employment section, after you entered all information about your business and income, you will have the expenses section. You will need to add all expenses type you have , like car expenses.

All you have selected, will show on the page (like a summary) of expenses type. You just have to click start and enter the information.

Thank you for choosing TurboTax.

37m ago

Related Content

ddennis-ot

New Member

bravestar37

New Member

amarisred

Level 1

camfromsk

New Member

mlecripps

New Member