Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Self-employed

- :

- Preparing spousal returns together, but one is self-employed and the other is standard. How can we file separately?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Preparing spousal returns together, but one is self-employed and the other is standard. How can we file separately?

Hi,

I am self-employed (started in 2020) and my husband is not. Prior to 2020, we have always prepared our returns together as Turbotax says that it is beneficial to do the returns together. I read a response from another similar question posted that says we can prepare it together but NETFILE separately so that I will be charged the self-employed return fee and he will be charged the standard return fee. We just finished preparing the tax return and in order to continue, it brings me to the payment page where both are charged at the self-employed fee and with no other option available but to pay before proceeding. How do we file separately at the different returns (self-employed and standard) cost? Please advise.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Preparing spousal returns together, but one is self-employed and the other is standard. How can we file separately?

Regardless of which version of TurboTax you are using, if you want to prepare your return together with your spouse, then you will both will be using the same version of the program, and you will both be charged the same price. You can only prepare your returns in different products if you prepare your returns separately.

To prepare your returns separately, you would choose to prepare for “Myself” to create a return only for one spouse when you are starting a new return.

If you are transferring your previous year’s information, you will get the option to transfer only one spouse’s return on the “Here's a snapshot of what we'll transfer”.

Unlike some other countries, there is no "joint" filing in Canada. Even if you can use TurboTax to prepare your returns together, they are still sent separately to the CRA, and the CRA still considers them 2 separate returns. And NETFILE is a free service provided by the CRA. When you pay for TurboTax, you are paying to use the software to prepare your return, not to pay for NETFILE.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Preparing spousal returns together, but one is self-employed and the other is standard. How can we file separately?

Thank you for your response. I will make note of this for future returns.

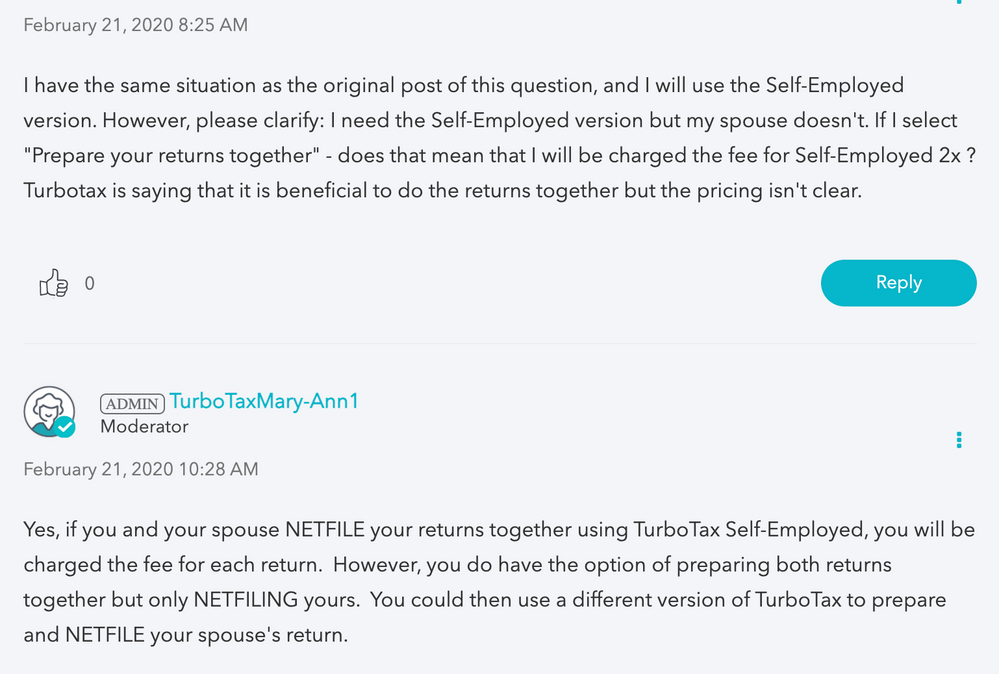

I have attached below a screenshot of the thread that made me pose this question as the moderator made it sound like we could prepare the returns together, but apply different products.

Related Content

sbirhane

New Member

Idea-Man

Level 1

dlpatt

Level 2

robertbmackie

New Member

mtrattne

New Member