Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Seniors & students

- :

- Re: If you have overpaid your CPP Contributions, TurboTax wil...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to claim CPP Overpayment that is usually reported on Schedule 8? There is no option in TurboTax to do so!

How to claim CPP Overpayment that is usually reported on Schedule 8? There is no option in TurboTax to do so! The CPP contributions are reported on T4 and overpayment should be calculated using CRA Schedule 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to claim CPP Overpayment that is usually reported on Schedule 8? There is no option in TurboTax to do so!

If you have overpaid your CPP Contributions, TurboTax will perform the necessary calculations and enter the overpayment on Schedule 8 based on the entries you make. You do not need to make any entries on Schedule 8 as the software will do it for you.

Any CPP or EI overpayments will be seen on your Detailed Tax Summary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to claim CPP Overpayment that is usually reported on Schedule 8? There is no option in TurboTax to do so!

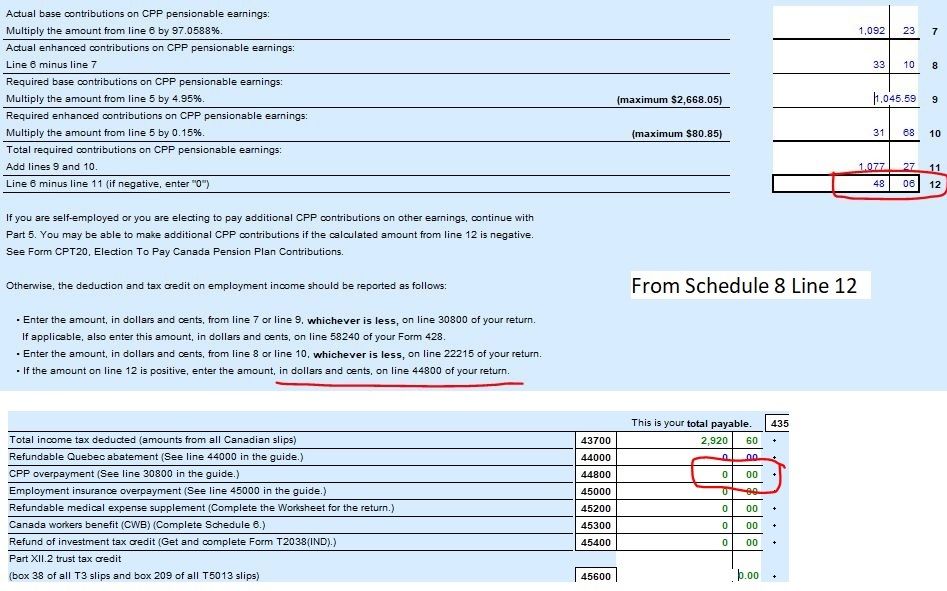

T1-General Line 44800 is 0.00 despite an overpayment of 48.06 showing on Schedule 8 - Line 12

There is no option to override this, even though it is clearly an error.

Please help correct this, it will not allow me to override box 44800 to input the overpayment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to claim CPP Overpayment that is usually reported on Schedule 8? There is no option in TurboTax to do so!

You have not provided enough information so we can help you. If you are filing prior years' returns, there is a limit from CRA on how far back you can go to claim the CPP and EI overpayment. CPP can go back 4 years, and EI can go back 3 years.

I have attached a copy of my duplicate of your problem in a 2019 version. I was able to claim a CPP overpayment.

I hope this was helpful

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to claim CPP Overpayment that is usually reported on Schedule 8? There is no option in TurboTax to do so!

Related Content

EdW

New Member

jeck_tinitigan

New Member

saekum_01

New Member

pogdub

New Member

qiushuo222

Returning Member