Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- 2023 RRSP contribution room

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 RRSP contribution room

I have been using TurboTax for many years.

The RRSP contribution room from 2022 carryforward to 2023 is different from what I received from CRA's Notice of Assessment.

CRA says I have no room whereas TurboTax says I do, amount of $2258.14

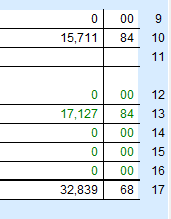

I looked into the reason for this discrepancy and believe there's a bug in the 2022 RRSP worksheet, Section 5.

Line item 10 is supposed to be from Line item 9, but the form does otherwise.

Please check and let me know if my observation is correct.

Thanks

Aldo Abate

[email address removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 RRSP contribution room

The amount that should be in box 10 is not showing in the box, but it is still being used correctly in the calculations.

It’s not uncommon for the CRA to change your contribution room amount, which is why TurboTax has a spot where you can enter the correct amount. Click on “Forms” in the blue icon bar, then search for RRSP. Choose the RRSP - Registered Retirement Savings Plan option. At the bottom of the pop-up you can enter your correct deduction limit, or answer yes to the question asking if it is zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 RRSP contribution room

Your reply is not correct.

The erroneous amount in Line 10 is in fact used for the rest of the calculations.

I verified with CRA and they say I have zero contribution room, whereas TurboTax says I have $2258.14

Check again please.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 RRSP contribution room

Please contact our phone support at 1-888-829-8608 as they will be better able to assist you. They can look at your return with you to see where that number is coming from.

Related Content

THEONECR7

New Member

Luch13

Level 1

BrianOm

New Member

cjhull621

Level 1

samloops

Returning Member