Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Loss Worksheet Issue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss Worksheet Issue

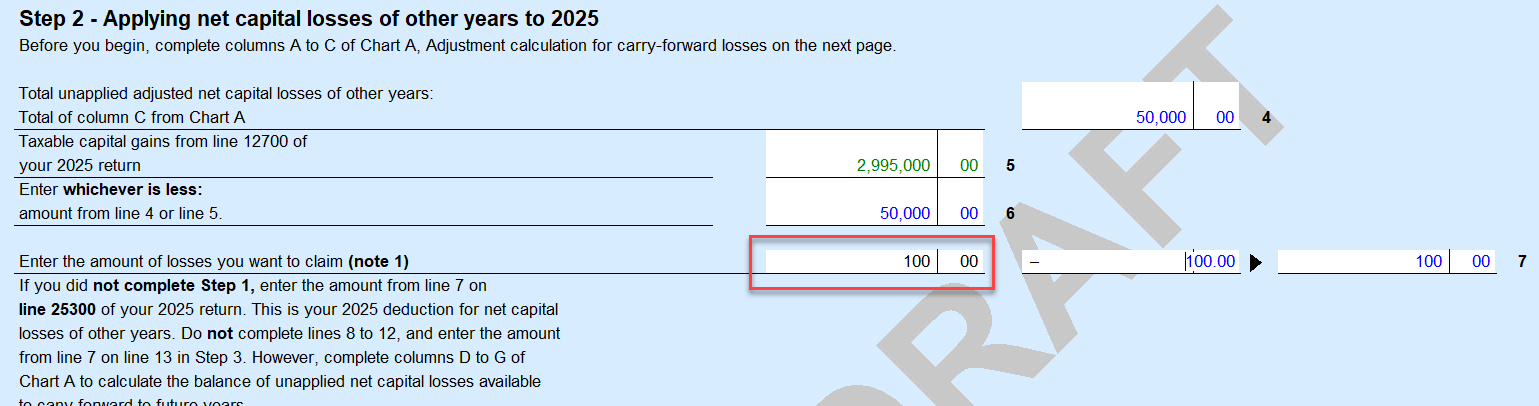

On the "Loss Worksheet," net capital losses of other years should not automatically be applied/claimed against current year taxable capital gains (line 7).

This is an optional amount and may not need to be (fully) utilized to reduce taxable income to zero, or the taxpayer may wish to carry forward the net capital losses of other years to future years.

The amount(s) to claim should be user input, not auto calculated by the software.

This issue has carried over from at least the 2024 tax year and software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss Worksheet Issue

You can change the amount of Net Capital Loss being claimed in the first box to the left of #7.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss Worksheet Issue

Thank you for that.

I will try that this tax year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss Worksheet Issue

Will that work with a zero value?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss Worksheet Issue

Yes, it will.

Unlock tailored help options in your account.

Related Content

Robert_Gibbs

New Member

charlesmitch

Level 2

JBBlair1

Level 3

TaiWai62

Level 2

Zerocool_Maverick

Level 2