Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: CPP exemption on Schedule 8 incorrect

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CPP exemption on Schedule 8 incorrect

For a person who turned 60 in 2021 and collected CPP retirement pension for 4 months, the CPP exemption should be the full $3,500. Schedule 8 Part 2 Box A shows 12 months for the exemption, which is correct. However, the basic exemption is prorated so that the exemption is only provided for 8 months.

As noted by TurboTax user @gabetosello 2 years ago, this is not correct. Schedule 8 lists the reasons for an exemption to be prorated, and it would not be prorated in this situation. TurboTax is getting the # of months for the exemption by using 12 months less the T4A(P) # of months, and only providing an exemption for 8 months. Again, as noted by the above TurboTax user, the problem can be remedied by changing the # of months on the T4A(P) to 12. It can also be remedied by leaving the # of months on the T4A(P) blank.

This is the way it worked in tax years prior to 2012, when a person no longer contributed once receiving the pension. It is not how it works now.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CPP exemption on Schedule 8 incorrect

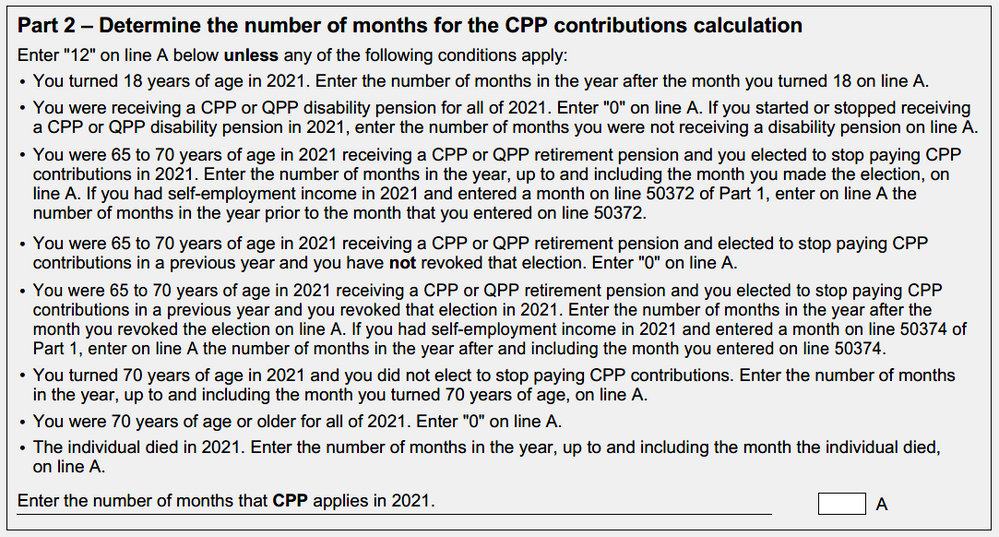

Yes, but that only applies if you start receiving a CPP or QPP Disability pension during the year. The # of months on the TurboTax Sch 8 is correct - it's 12, even if the person has only collected CPP retirement pension for 4 months of the year. The exemption calculation in TurboTax is ignoring this. See part 2 of Schedule 8, as well as Section 19 of the Canada Pension Plan Act (at https://laws-lois.justice.gc.ca/eng/acts/C-8/page-5.html#h-168214), for when it will not be 12 months:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CPP exemption on Schedule 8 incorrect

I just verified this- As per CRA- If you started receiving CPP retirement benefits in 2021, your basic exemption may be prorated by the CRA. So yes, the basic exemption is prorated so that it is only provided for 8 months as the other 4 months you collected CCP retirement pension.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CPP exemption on Schedule 8 incorrect

Thanks Brenda, but it would only be prorated if the person elected to not contribute to CPP. The person who brought this to my attention is only 60, so is too young to elect to stop contributing. He also checked with CRA, who gave him the same answer as I gave him. Unfortunately, CRA doesn't always give correct responses. The other occasion where it would be prorated is if the person turned 18 or 70 in the year.

See the examples at https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/payroll-deductions-co..., in particular Example 3 which is for a person who is already collecting their pension and then elects to not contribute any more.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CPP exemption on Schedule 8 incorrect

Here is a screenshot of the page and what it shows-

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CPP exemption on Schedule 8 incorrect

Yes, but that only applies if you start receiving a CPP or QPP Disability pension during the year. The # of months on the TurboTax Sch 8 is correct - it's 12, even if the person has only collected CPP retirement pension for 4 months of the year. The exemption calculation in TurboTax is ignoring this. See part 2 of Schedule 8, as well as Section 19 of the Canada Pension Plan Act (at https://laws-lois.justice.gc.ca/eng/acts/C-8/page-5.html#h-168214), for when it will not be 12 months:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CPP exemption on Schedule 8 incorrect

I just downloaded an update for TurboTax and I see this has now been corrected! Awesome.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CPP exemption on Schedule 8 incorrect

My download from CRA shows no months for a 25 year old employee. This causes no CPP deduction and all shown as CPP overpayment. When I enter the 12 months it is right but will not allow me to efile due to the override.

Any suggestions as I would like to efile

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CPP exemption on Schedule 8 incorrect

Did you happen to NetFile your return as of yet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CPP exemption on Schedule 8 incorrect

No. I tried once but it said there was an error. I was hoping cra would change it and correct the mistake. I deleted the t4 and entered by hand but same result as cra download.

I can not override to change and cannot net file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CPP exemption on Schedule 8 incorrect

Please contact our phone support team at 1-888-829-8608 as you can share your screen with them and they will be better able to assist you after looking at your return.

Related Content

C Zhou

New Member

THEONECR7

New Member

rjoannis

New Member

rlyl

New Member

Kitkat68

New Member