Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: TurboTax Online 2023 Downloaded T1 appears to have reversed Ontario Non-Refundable Tax Credit...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online 2022 Downloaded T1 appears to have reversed Ontario Non-Refundable Tax Credit and Ontario TOSI strings

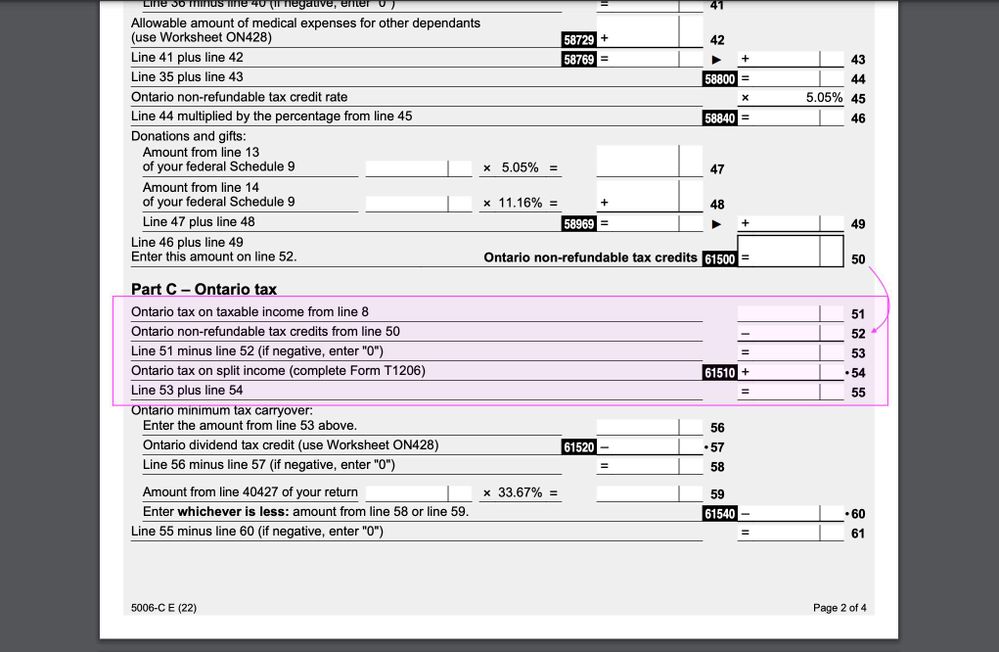

I have looked at this carefully, and I am pretty certain that the Downloaded T1 from TurboTax Online 2022, has incorrectly reversed the line-names for these two lines (see attached). Note: This section is also in a different order from the downloaded T1 last year in 2021.

It seems TurboTax is doing the "right thing" in the actual flowing calculations (I think), but if the line names were reversed in the downloaded T1, it would be correct.

Line 50 has a value, but it's not being injected into the indicated line 52.

Line 54 is getting that value instead.

This is a return where Ontario TOSI is not being claimed.

So I believe line 52 is actually the Ontario TOSI, and line 54 is actually the Ontario Non-refundable tax credit from line 50 and should be labelled as such.

And line 55 should say "Line 53 minus line 54".

That's what is was last year, in the downloaded 2021 T1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online 2022 Downloaded T1 appears to have reversed Ontario Non-Refundable Tax Credit and Ontario TOSI strings

I also checked a separate return I am preparing, and downloaded that T1 also, and it shows the same issue.

So this issue in the T1 is not TurboTax-account-specific.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online 2022 Downloaded T1 appears to have reversed Ontario Non-Refundable Tax Credit and Ontario TOSI strings

Ok, I checked an ON428 downloaded from CRA this morning (see attached).

https://www.canada.ca/en/revenue-agency/services/forms-publications/tax-packages-years/general-incom...

So, while this part of my original post quoted below is incorrect - (they have switched the "plus" and "minus" orders and logic in 2023:

So I believe line 52 is actually the Ontario TOSI, and line 54 is actually the Ontario Non-refundable tax credit from line 50 and should be labelled as such.

And line 55 should say "Line 53minus line 54".

I believe this part of my post below is still correct, and TurboTax Online is injecting the incorrect values into Lines 52 (TOSI), and Line 54, in the downloaded T1 when no TOSI is claimed:

Line 50 has a value, but it's not being injected into the indicated line 52.

Line 54 is getting that value instead and vice versa.

To Summarize: In TurboTax Online's downloaded T1: It appears the contents of Line 54 should be where Line 52 is, and the contents of Line 52 should be where Line 54 is.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online 2022 Downloaded T1 appears to have reversed Ontario Non-Refundable Tax Credit and Ontario TOSI strings

what if turbotax doesn't fix the error, then have to submit the wrong tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online 2022 Downloaded T1 appears to have reversed Ontario Non-Refundable Tax Credit and Ontario TOSI strings

> what if turbotax doesn't fix the error, then have to submit the wrong tax return?

My guess as a software developer, is given line 55 (the calculation) is correct in the PDF, the NETFILE may be correct, so you wouldn't have to file an adjustment. That is my guess... but let's see what TurboTax says.

My theory on what is happening (again a guess) is that that PDF "templating system" the TurboTax developers may be using to build this downloaded PDF, has the those 2 fields "rendered" in the switched locations for PDF output. But the filed identifiers under the hood, are still correct for a NETFILE.

Ultimately, I don't know.

But yes, that is my concern also. eg. 61510 if it is reported in a NETFILE, is being reported during as Ontario Tax on Split Income, and vice versa.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online 2022 Downloaded T1 appears to have reversed Ontario Non-Refundable Tax Credit and Ontario TOSI strings

Thank you for your feedback- I will be sure to send this over to our proper team to take a look at and we will be back with a resolution for you as soon as possible.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online 2022 Downloaded T1 appears to have reversed Ontario Non-Refundable Tax Credit and Ontario TOSI strings

Awesome, thank you so much Brenda. I am keeping an eye on this Support ticket daily.

I don't plan to NETFILE, or even print my T1 locally, until we know more.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online 2022 Downloaded T1 appears to have reversed Ontario Non-Refundable Tax Credit and Ontario TOSI strings

I re-tested all my T1 downloads from TurboTax Online 2022 (both Self-Employed, and Deluxe) again this morning, March 26th, 2023.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online 2022 Downloaded T1 appears to have reversed Ontario Non-Refundable Tax Credit and Ontario TOSI strings

Hi, any update on this bug please?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Online 2022 Downloaded T1 appears to have reversed Ontario Non-Refundable Tax Credit and Ontario TOSI strings

Can you please make sure you update your software and know that the numbers should be good now. If not, can you please send us a picture of your screen so that we can assist further or your will need to call our phone support team who can view your screen and advise you. Contact us

Thank you for choosing TurboTax.