Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- T2209 isn't calculating correctly

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T2209 isn't calculating correctly

I've entered Foreign Non-Business income from T-slips and the numbers show up correctly on T2209 as $32.94 on Line 1. The calculation on Line 2 is $22.66. Line 3 is supposed to be the "lessor of the two" but shows as '$0'. This is incorrect and means the Foreign Tax Credit is lost. Must be a bug because this is wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T2209 isn't calculating correctly

If you haven't been able to resolve this issue since posting your question, please call us so we can help: https://turbotax.community.intuit.ca/replies/3152013

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T2209 isn't calculating correctly

I have the same error which I confirmed using StudioTax2019 (each year I confirm the accuracy using StudioTax). A couple errors, actually.

The amount from a T3 is shown correctly on the worksheet supplement to T2209. In my case $66.87

On line 43100 of the T2209 it shows as $40.25, for no reason. This is lower than the computation for the tax credit which is a percentage of the tax actually paid (the lower of the two, so you can guess what's lower - the $40.25).

Clicking on the amount in T2209 opens the worksheet (where it is correct, e.g. $67.87). Clicking on the amount in the worksheet opens the T5 entry form. The problem is, the amount was entered on the T3 entry form, not the T5, so there's your second error. Turbotax opens an entry form for a T slip that doesn't have this income.

Suggestion - download the local software version of StudioTax2019 and use an application that works.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T2209 isn't calculating correctly

Further info - in my case the tax credit on the foreign income seems to be limited to 15% for a T3 (the error opening the T5 entry screen is still an error).

15% is $40.25 so it appears that I cannot get a credit in excess of that.

However to the original post, $0 sounds downright impossible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T2209 isn't calculating correctly

I have this problem too, is there a solution Turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T2209 isn't calculating correctly

I think I have some clues: I must have been below some income threshold: when I added more of my income slips suddenly the "lesser of line 1 or 2" started to actually pick the lesser value and bring it into my return. My theory is that some kind of threshold of income is needed before this works.

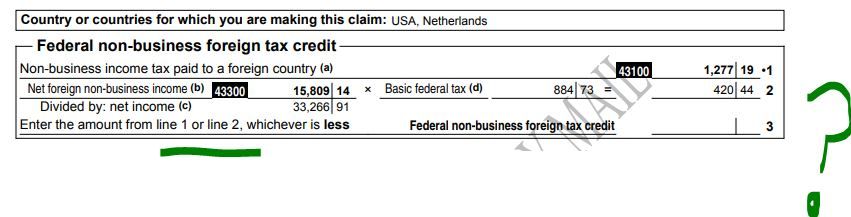

This is good enough for me, as I see a non-zero value in line #3 in my screenshot

TurboTax people: you sure would help people if you put in some more information about this i.e. "you don't get a foreign tax credit even though you paid foreign tax because of <insert detailed reason here>. You would have saved my and your support team (I called them) quite a lot of time, plus the three other people with the problem in this thread. Hope you can improve this area in the future, thanks for considering!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T2209 isn't calculating correctly

I ran into a issue in the 2020 version with Foreign Tax Credit. In this case, form 2209 was corrected. I had 3 slips with foreign income, and the 3 were summarized in the 2209S. However, TurboTax did not correctly fill in the T1-KFS values. Instead of the correct values in 2209S, the values from one of the input was included. Since I was not eligible for NetFiling this year, I mailed in the condensed form which includes the T1-KFS. Once CRA keys in this incorrect data, then the total Foreign Tax Credit was not applied. I reviewed the full return and see that the foreign tax credit is included. I now have to file a T1-adjustment to try to correct this. I'm surprised that this hasn't been reported yet. I've tried to submit a bug report to Intuit but there isn't an obvious way to do that!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T2209 isn't calculating correctly

Same thing happened to me! We have foreign employment and foreign investment income, with foreign taxes on both. This appears to have entered the TurboTax system correctly, as the long form return duplicate that TurboTax generated shows three different TT209 forms that cover these two sources. However, only the foreign investment associated tax credit was reported on the condensed T1 that TurboTax generated for mail submission to the CRA, while the much larger foreign tax credit associated with employment income was not transferred over. This led to the CRA declaring a calculation error on the notice of assessment, and reducing my refund by $1900 below what TurboTax had calculated. Very disappointing, especially after upgrading to the most expensive TurboTax offering. I am now in the process of amending my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T2209 isn't calculating correctly

I also filed an amendment and quickly received a refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T2209 isn't calculating correctly

This is occurring in as well in 2021 Premier. There is no way to override. I went back to 2020 and found the same issue.

Related Content

needtaxhelp3

Returning Member

tjug7961

New Member

vmansinger419

Returning Member

CBLIA45

New Member

EG001

Returning Member