Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Credits & deductions

- :

- principal residence exception

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

principal residence exception

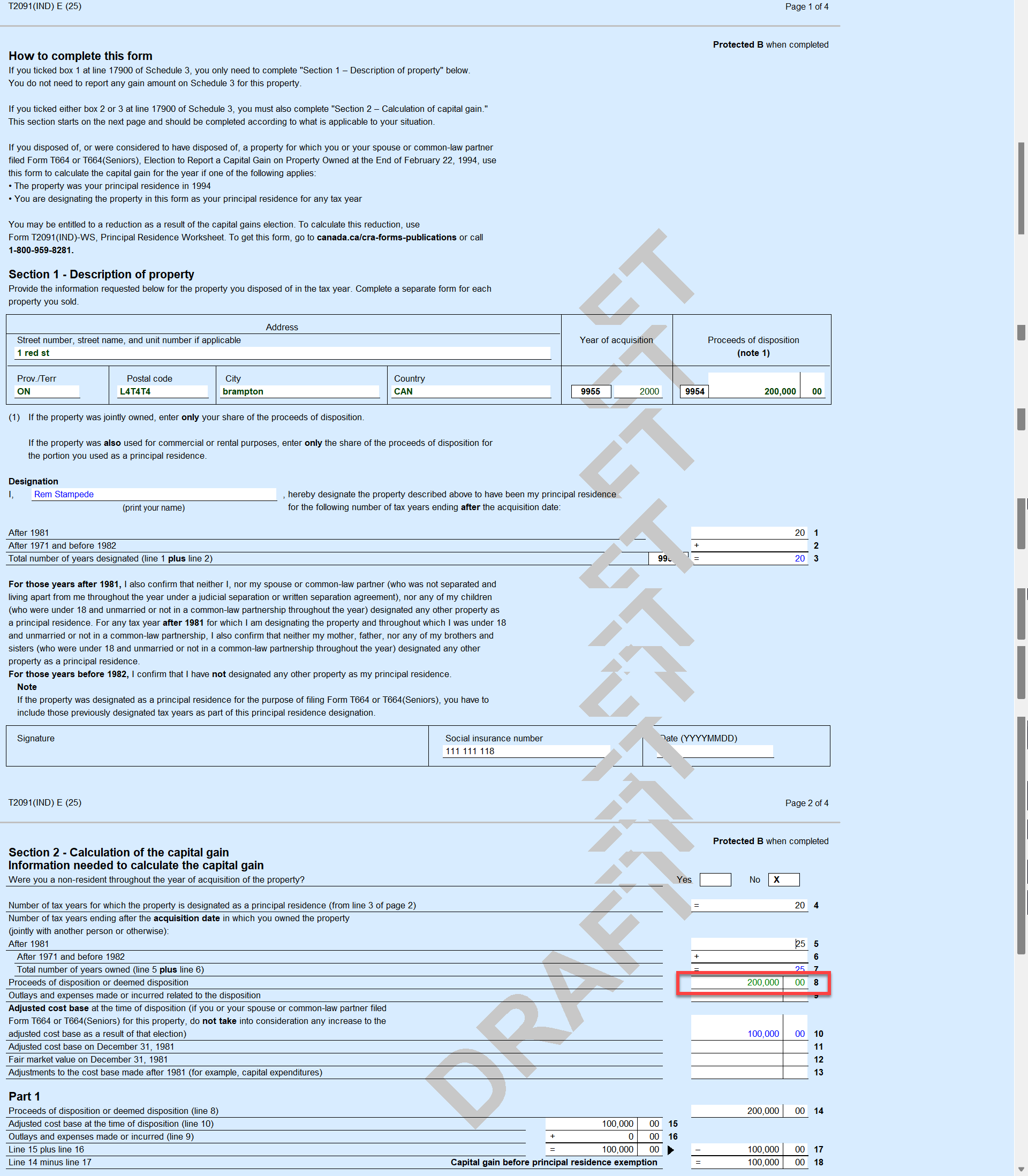

Please verify that forms PRWS, T2091(1) and schedule 3 are working. When entering values in form PRWS the proceeds of disposition appear at the top of form T2091(1), but doesn’t flow to line 8 and calculations cannot be completed. When filing 2 returns my spouse and I, do I have to split the Adjusted cost base and Proceeds of disposition.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

principal residence exception

Are you using TurboTax Desktop or TurboTax Online? And what year are you preparing your return for?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

principal residence exception

Using Turbotax Canada 2025 desktop and preparing tax return for year 2025

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

principal residence exception

Yes, you will have to split the Adjusted cost base and Proceeds of disposition.

If the T2091 isn't calculating properly, please make sure that you've filled out the PRWS & T2091 completely, including the year purchased and the years owned/principal residence.

Note: If the whole home was your principal residence the entire time you owned it, then you won’t have capital gains (or losses) due to the sale.

Unlock tailored help options in your account.

Related Content

user17679055925

New Member

stephunderscoremoore

New Member

colleenhickey04

New Member

dsjram

New Member

Amyvn

Returning Member