Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Credits & deductions

- :

- What do I do if the new "Sale of a principal residence" section does not ask enough information and is wrong?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if the new "Sale of a principal residence" section does not ask enough information and is wrong?

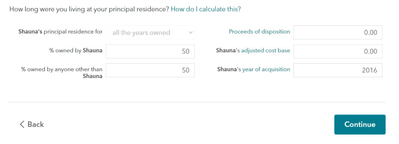

It is asking for the following:

1) Amount of time as principal residence (whole duration)

2) % of ownership for myself, and other people (50/50 me and ex husband)

3) Proceeds of Disposition: According to the CRA, this is the sale price of the home (288xxx)

4) MY "Adjusted Cost Base": According to the CRA, this is the sale price + fees at which I purchased the home originally (311xxx)

5) Year in which I bought the house (2016)

However, when I proceed through the next questions about who the home is sold to, and years owned/lived in - it spits out the summary as follows:

(Address of home) - Proceeds $144xxx - Captial Gain/Loss $0

However, I did not make 144k on my house sale. I made $30k after the mortgage was paid off, realtors were paid, legal fees, and me and my ex got our portions split up. The questions TurboTax asks, does not allow for enough information to accurately have an actual amount reported to the CRA. What am I supposed to do here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if the new "Sale of a principal residence" section does not ask enough information and is wrong?

As per our TurboTax article: Changing Your Principal Residence In Canada, if you sell property for more than you paid for it, your profit is usually subject to capital gains tax. Your PR, however, is usually exempt from capital gains rules. If you’ve made a tidy profit from the sale of your PR, all you’ll need to do is report the sale details on your tax return. As long as your home was your principal residence for the entire time you owned it, your profit will not be taxed.

All the information the Canada Revenue Agency (CRA) requires is in the return's questions as required.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if the new "Sale of a principal residence" section does not ask enough information and is wrong?

Hi there,

Thank you for the reply - but it still did not answer my question about what to put where.

There is no combination of numbers that I can enter, which will correctly display the actual proceeds I received for my home sale. For example, if I bought for $311,000.00 and sold it for $288,500.00, but after the outstanding mortgage repayment, realtor fees, lawyer fees, and the amount my ex-husband got, If I only actually received $30,000.00.... there is no way to input that into the software how it's set up.

If I put the amount we sold the house for in the "proceeds of disposition" box, it simply splits it 50/50 and assigns me a $144,250.00 proceed amount. I did not get that much for my house.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do I do if the new "Sale of a principal residence" section does not ask enough information and is wrong?

Please contact the Canada Revenue Agency(CRA) about this as they can inform you better about their information needed and how it is calculated according to their request. They can be reached by calling 1-800-959-8281.

Thank you for choosing TurboTax.

Related Content

rms1956

New Member

bheans-gmail-com

New Member

rhung_99_c

New Member

imsigal

New Member

andreaandradeurr

New Member