Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Filing, printing, post-filing

- :

- Filing

- :

- Re: Basic Federal tax

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basic Federal tax

Hi, i am non-resident earning less the 12K working and living in Canada for 6 months in 2019 and 5K living 6 months overseas .

In turbo tax standard the basic fed tax rate reports 0 on the 11K until i say "Yes" to world income then it jumps to 2362.92 without entering any net income. why is this? thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basic Federal tax

You don't pay taxes on your incomes from a foreign country if you earn it prior to entering Canada. However, this amount is required to calculate how much personal amounts you are qualified for. This is why your amounts might have changed when you reported this income.

I hope this was helpful

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basic Federal tax

Thanks for the reply. In Statement of World income schedule A section turbo tax states.

"Complete this section if you were a non-resident or a deemed non-resident of Canada for all of 2019"

As i was non-resident for only some of 2019 not all of it then from this statement do i still have declare world employment income outside of Canada. I was non resident from June 1 2019 . Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basic Federal tax

Yes, If you were a resident until June 1st > enter this date in the software, the world income after the date > the software will generate the form for you and will calculate the proper non-refundable tax credits you are eligible for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basic Federal tax

Thank you for the reply , i am really trying to understand why i owe taxes.

While resident In Canada until June 2019 my income was $11,400

From June to Dec 2019 i live overseas and my earnings are $5500 (this would be my world income)?

I have no RRSP,investments or any other income and the software reports i owe $1300.

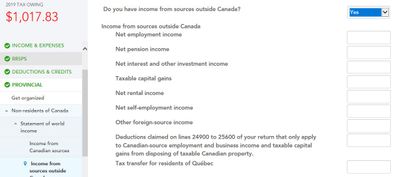

Without the world income there is a refund. Just checking the yes box in "do you have income outside Canada"

it changes from tax refund to owing without entering any income. All taxes were paid at the sources. do not understand why i owe. Thanks again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basic Federal tax

Once you reported your foreign income, your non-refundable tax credits have been prorated by this equation:

You divide your net income by your world income, and in your case, the calculation results in less than 90%. So you will claim 15% of your non-refundable tax credits > and will end up owing taxes.

You will have to report your world income > so you have to report this $5500.

I hope this was helpful

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basic Federal tax

Thanks for your reply.

My 2019 earnings in Canada were Gross $11,000 and $1200 tax . In Australia my earnings for 2019 were $5500 gross $772 tax . From declaring world income i don't understand why i would have to pay another $1000 tax. If i say no to world income there is a $1000 refund. Can it change that much just by saying yes to world income? I did not enter any mount in any of the income boxes and it changes to tax owing soon as the Yes box is checked for "Do you have any income from outside Canada".

This is a very basic tax filing and all taxes were taken at source at the correct amount and there are no other investments, RRSP's or other credits to claim. Thanks for any help with all this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basic Federal tax

I agree it is a basic tax filing. First, let us decide the period of residency; Enter your correct dates. I will share with you circumstances used by CRA to determine your residency and basis of being taxed on your world income. This I hope will bring clarity to your questions:

and

https://turbotax.intuit.ca/tips/do-you-need-to-declare-income-earned-from-sources-beyond-canada-6227

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Basic Federal tax

Canadian Citizen

Resident in Canada Jan -June 1 2019, (152 days)

Resident in Australia June 2 2019 to present.

No significant residential ties in either country.

Secondary ties in Canada , Bank account/ drivers license, Passport , personal items(clothes, furniture)

Would i file for resident or non resident?

If i file as resident i enter income in foreign income section and there is a refund

If i file as non resident i enter income in Statement of world income and there is tax owing.

In Turbo tax it asks "What province did you live in on Dec 31, 2019" i would have to answer non-resident?

Thanks

Related Content

marianesfeir

New Member

archivister

New Member

kashandeh

New Member

gsto30833

New Member

sunkistfong

New Member