Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Filing, printing, post-filing

- :

- Filing

- :

- T200S don't qualify for the employment expenses deduction this year?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T200S don't qualify for the employment expenses deduction this year?

Hi Guys,

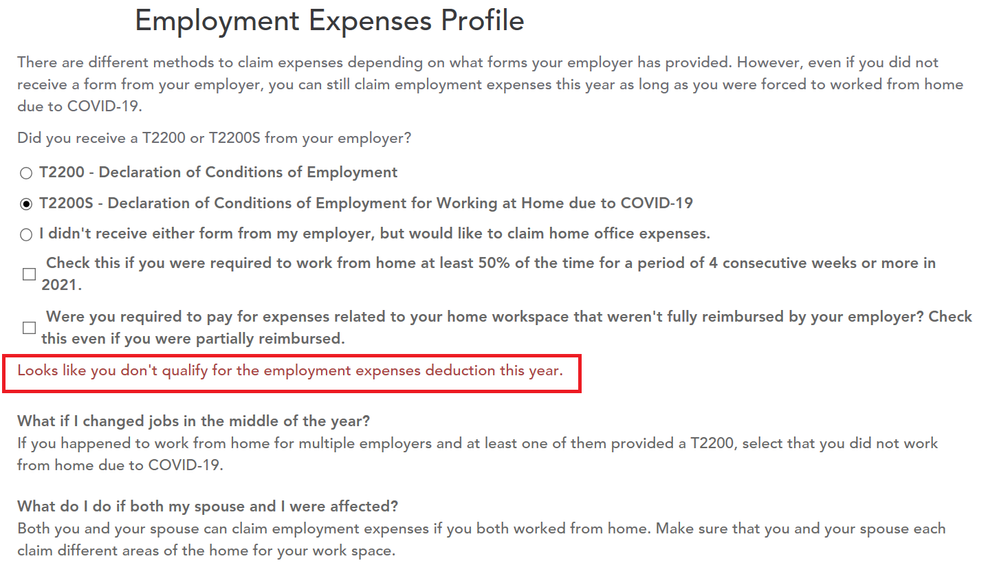

I worked from home for the entirety of 2021 and am filing my taxes in Ontario. I received a signed T2200S from my employer. As per the attached pic though, anyone know why it says I don't qualify for the employment expenses deduction? I can't seem to find any reasons why I am not eligible on CRA's website, given my company has an office but I did indeed work from home...

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T200S don't qualify for the employment expenses deduction this year?

There are 2 checkboxes just above the red text. If both apply to you, check them off and you will be able to continue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T200S don't qualify for the employment expenses deduction this year?

Ahh, only the:

"Check this if you were required to work from home at least 50% of the time for a period of 4 consecutive weeks or more in 2021."

Applies to me...So I guess that means I am not eligible. Sigh....

Unlock tailored help options in your account.

Related Content

rochellerochelle

New Member

hockey-chick

New Member

Jonny1

Level 1

dioria

Level 2

djo1

New Member